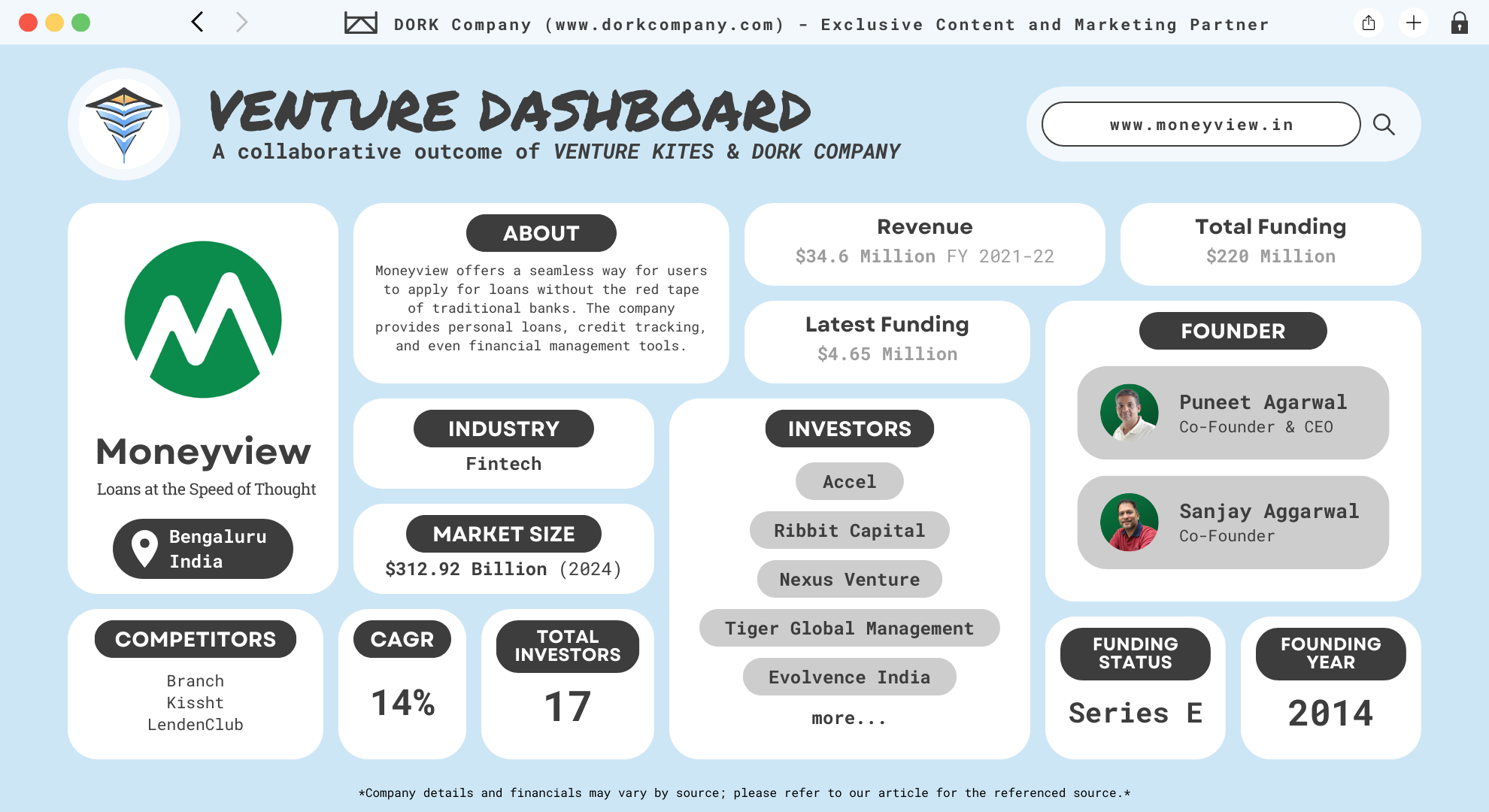

Moneyview : Loans at the Speed of Thought, A Journey from Startup to Unicorn

Founded in 2014 by Puneet Agarwal and Sanjay Aggarwal, Moneyview was built to tackle a simple yet critical problem: making loans more accessible to underserved people in India. It started in Bangalore, India, and continues to operate from there today as one of the country’s most recognized fintech platforms. (Moneyview)

Moneyview offers a seamless way for users to apply for loans without the red tape of traditional banks. The company provides personal loans, credit tracking, and even financial management tools. All you need is a smartphone, and you can access personalized credit offers in minutes. No endless paperwork, no long waits at the bank. They have built their service using advanced AI algorithms, allowing them to assess customer risk efficiently and offer credit solutions to people who might otherwise struggle to qualify for loans.

With over 45 million app downloads and loans disbursed to over 19,000 locations, Moneyview is helping bridge the gap between formal financial systems and underserved communities. The platform boasts a fast-growing customer base, disbursing over ₹12,000 crores in loans. Whether you’re looking for a quick loan, or just want to monitor your credit, Moneyview has built a tool that gives you the freedom to manage your finances more efficiently.

Brains Behind the Bucks: How a Chat Created a Fintech Giant

Founded in 2014 by Puneet Agarwal and Sanjay Aggarwal, Moneyview was created with the goal of providing easy access to credit for underserved Indians. Together, these two IIT friends saw the vast gap in India’s lending ecosystem. They realized that millions of Indians were underserved by traditional banking systems, and they aimed to fill this gap using AI-driven credit solutions. In 2014, they launched Moneyview from Bangalore, focusing on providing accessible and personalized loans to individuals across the country.

Puneet Agarwal

Puneet Agarwal’s journey began with a strong academic foundation, having completed his B.Tech from Indian Institute of Technology (IIT), Delhi, followed by an MBA from Purdue University’s Daniels School of Business. Before co-founding Money View in 2014, Puneet had a rich experience in product management, serving at global giants like Google. At Google, he worked as the Product Management Director from 2011 to 2013.

Also, Money View wasn’t Puneet’s first brush with entrepreneurship. He had also been an investor since 2012, advising and investing in early-stage startups. His diverse experience also includes his role as a board member of Madura Micro Finance Ltd and COO of Bling Nation, a mobile commerce platform. (Puneet Agarwal)

Sanjay Aggarwal

A graduate of the prestigious Indian Institute of Technology (IIT) Delhi, where he earned his BTech in Engineering, Sanjay’s career spans over two decades. Before stepping into the entrepreneurial world, he gained valuable experience working with tech giants. He was an Engineering Manager at Yahoo! from 2004 to 2006, and prior to that, he served as a Principal Software Engineer at Ciena Corporation and Appian Communications Inc. Sanjay’s entrepreneurial journey also began early on in 2006 when he co-founded Minglebox.com, an online platform that provided educational services, where he served as the CTO for over seven years. (Sanjay Aggarwal)

This powerful combination of tech and finance expertise helped Moneyview grow rapidly into one of India’s leading digital lending platforms. Their shared goal is to provide credit to the 90% of Indians who are often ignored by formal banking institutions.

Fintech Fever: Moneyview is Tapping into India’s Billion-Dollar Market

The fintech industry is on a rapid ascent, showing no signs of cooling down. Estimated at $312.92 billion in 2024, it’s projected to reach a staggering $608.35 billion by 2029, with a CAGR of 14%. Fintech is reshaping the way we manage payments, savings, and investments, bringing financial services to more people than ever before. (Mordor Intelligence)

A major driver of this growth is the rise of fintech apps. By 2024, the average consumer is expected to use over three apps to manage their finances—ranging from mobile payments to alternative lending solutions. This surge in app usage stems from the growing demand for convenience and speed, especially during economic uncertainty, when digital financial tools offer much-needed stability.

Emerging technologies like artificial intelligence (AI) and blockchain are transforming the industry’s backbone. AI is revolutionizing personal finance by automating budgeting and investment decisions, while blockchain enhances transaction speed and security.

Meanwhile, regulatory technology (RegTech) is gaining ground, particularly in regions like Europe where financial regulations are highly intricate, enabling fintech companies to maintain compliance without hindering innovation. As real-time payment systems like FedNow take off, instant payments are set to become an integral part of the financial ecosystem. (Fortune Business Insights)

Lending a Hand: How Moneyview is Redefining Financial Inclusion

Moneyview providesprovide world-class financial products to everyone with a smartphone. The company began as a personal financial management app and by 2016, it shifted focus to digital lending, helping millions of underserved Indians access credit. They aim to drive true financial inclusion in India, targeting the 90% of the population left out of formal credit systems.

Their vision is rooted in inclusivity. They aim to bridge the gap for those left out of traditional banking systems by using technology to simplify borrowing. The company operates on three core principles: fully personalized solutions, a frictionless digital process, and responsible lending. Their approach is designed to help users build healthy credit histories with transparency at every step. (About Moneyview)

Problems They Solve

Moneyview addresses the fundamental problem of financial exclusion. Traditional banks often reject individuals with limited credit histories, leaving a large segment of the population without access to loans. Moneyview’s AI-based risk models offer a solution by providing credit to those typically turned away, reducing financial inequality. Additionally, they simplify the loan process with paperless, fast disbursements, removing the usual bureaucratic hurdles.

Business Model

Moneyview’s business model revolves around a revenue-sharing arrangement with non-banking financial companies (NBFCs). They acquire and manage customers while their lending partners provide the necessary capital. This structure allows them to focus on scaling their digital platform, with their revenue largely coming from fees and commissions on loan disbursements. Their ability to maintain profitability, evidenced by a significant 27X spike in profits in FY23, is a testament to the strength of their model.

All in One Wallet: From Personal Loans to Gold Investments

When it comes to financial solutions, Moneyview has you covered with a powerful range of products designed for easy and quick access to credit. Let’s dive into what makes Moneyview stand out in the crowded fintech space.

1. Personal Loan

Moneyview’s Personal Loans offer quick, paperless loans ranging from ₹10,000 to ₹5,00,000. The loans come with flexible repayment tenures from 3 months to 5 years. The interest rates range from 1.33% to 2.00% per month, depending on the user’s credit profile. Applicants can check their eligibility in just 2 minutes, and loans are disbursed within 24 hours upon approval. (Personal Loan)

2. Credit Tracker

Moneyview’s Credit Tracker is a free tool that helps users monitor their credit scores in real time. The tracker updates scores based on the user’s credit behavior, helping improve their credit health. It also provides personalized tips and strategies to boost the score, a crucial feature for anyone looking to apply for loans. (Credit Tracker)

3. Business Loan

Moneyview offers Business Loans designed for MSMEs (Micro, Small, and Medium Enterprises). These loans range from ₹50,000 to ₹5,00,000 with repayment periods up to 3 years. The application process is 100% digital, requiring minimal documentation, and loans are processed within a few days, making it ideal for businesses needing quick financial support. (Business Loan)

4. Smart Pay

With Smart Pay, users can manage all their payments seamlessly from one platform. It supports bill payments, recurring payments, and allows users to set payment reminders. Smart Pay integrates with users’ bank accounts, offering real-time visibility of their financial status. (Smart Pay)

5. Credit Card

Moneyview offers a Credit Card facility that caters to users with varying credit profiles. The card comes with features like zero annual fees for select users, flexible credit limits, and seamless integration with the Moneyview app for easy tracking of expenses. Users can also opt for EMI conversion on large transactions. (Credit Card)

6. Home Loan

Moneyview’s Home Loans provide financing for property purchases with loan amounts up to ₹2 crore. These loans come with competitive interest rates and flexible repayment options, tailored to meet the needs of both first-time home buyers and those looking for refinancing options. (Home Loan)

7. Loan Against Property

For users who own property, Moneyview offers Loans Against Property (LAP). This secured loan allows users to leverage the value of their property for larger loan amounts, typically ranging from ₹5 lakhs to ₹5 crores. The loan tenure can extend up to 15 years, with lower interest rates compared to unsecured loans. (Loan Against Property)

8. FD Select

FD Select allows users to compare and select fixed deposit (FD) options from various banks. This feature enables users to find the best interest rates and lock their money in safe, high-yield FDs. The platform provides complete transparency on interest rates, tenure, and liquidity. (FD Select)

9. Motor Insurance

Moneyview has expanded into Motor Insurance, offering competitive rates for car and bike insurance. Users can choose from comprehensive plans that cover accidents, theft, and third-party liabilities. The digital process ensures quick issuance of policies without paperwork. (Motor Insurance)

10. Moneyview Gold

In partnership with ICICI Prudential, Moneyview offers digital gold investment options. Users can buy and sell 24K digital gold starting from as low as ₹1. This product is perfect for those looking to diversify their savings without the need for physical gold storage. (Moneyview Gold)

11. EMI Calculator

Moneyview’s EMI Calculator helps users estimate their monthly EMI payments for loans. This tool is available for all types of loans—personal, business, home, or gold. Users input the loan amount, tenure, and interest rate to get instant results on their EMI burden. (EMI Calculator)

AI Ain’t Playing: The Tech That Powers Moneyview

Moneyview is powered by some of the most advanced AI-driven technology in the fintech space. From credit scoring to loan disbursements, every step is streamlined by artificial intelligence (AI) and machine learning (ML) algorithms, making lending faster, more accurate, and more inclusive.

AI-Powered Credit Scoring

One of the standout features of Moneyview is its AI-based credit scoring model. Traditional banks rely on limited credit history to assess a borrower’s eligibility, often leaving many people unqualified. However, Moneyview’s AI algorithms use alternative data sources, such as utility payments, spending patterns, and even social behavior, to evaluate creditworthiness more comprehensively.

Automated Decision-Making

Moneyview’s loan processing system leverages automation to approve loans swiftly, sometimes within minutes. The AI technology processes vast amounts of financial data and performs risk assessments in real-time. This automated system reduces the need for manual intervention, lowering operational costs and speeding up loan disbursements.

Fraud Detection and Security

Their AI tools continuously monitor transaction data, identifying unusual patterns that could indicate fraud. This real-time fraud detection helps safeguard both the company and its users from unauthorized transactions.

Optical Character Recognition (OCR)

Moneyview uses OCR technology to extract and process data from physical documents like bank statements or tax records. This significantly reduces the time required to verify loan applications.

It Takes a Village : The Support That Made Moneyview A Unicorn

The company has provided 45 million app users with access to personalized credit solutions, making financial inclusion a reality for many underserved individuals in India. In terms of recognition, Moneyview’s innovative solutions and financial inclusion efforts have garnered significant attention, including being cited as one of the most impactful fintech companies driving responsible lending in India.

Moneyview has forged strategic partnerships to enhance its financial offerings and reach a wider customer base. One of its significant collaborations is with Truecaller, a global platform known for contact verification. This partnership enables Moneyview to leverage Truecaller’s vast user base, ensuring better communication and verification processes for its customers. (Truecaller)

In 2024, Moneyview also expanded its portfolio by acquiring Jify, a fintech startup that provides employees with on-demand salary access. This acquisition allows Moneyview to enter the growing employee benefits sector, offering salary advances. Furthermore, Moneyview has secured partnerships with NBFCs (Non-Banking Financial Companies), including Whizdm Finance, ABFL, CLIX, DMI Finance and more to offer personalized loan solutions. (The Economic Times) (NBFC Partners)

A Capital Boost : The Millions Backing Moneyview’s Rise to the Top

Moneyview has secured significant funding over the years, attracting top-tier investors and achieving remarkable growth. Here’s a detailed breakdown of its funding journey (Tracxn):

Seed Round (November 5, 2014)

In its initial phase, Moneyview raised $1.7 million in a Seed round, reaching a valuation of $6 million. The company’s early-stage revenue stood at $18.1K, with a multiple of 328.7x. Investors included Accel and Ribbit Capital, who saw the potential in Moneyview’s digital lending platform.

Series A (April 20, 2015)

Moneyview raised $8.5 million in its Series A round, achieving a valuation of $27.5 million. With revenue of $47.1K, the company achieved a multiple of 582.7x. Leading investors in this round included Tiger Global Management, Ribbit Capital, and Accel.

Series B (January 22, 2016)

During its Series B round, Moneyview raised $9.7 million, elevating its valuation to $46 million. The company’s revenue had grown to $323K, reflecting a multiple of 142.4x. Investors from previous rounds, including Accel, Ribbit Capital, and Tiger Global Management, continued their support.

Series C (October 3, 2018)

In Series C, Moneyview secured $18.9 million at a valuation of $74.4 million. The company reported revenue of $3.3 million with a multiple of 22.5x. Accel, Dream Incubator, and Ribbit Capital were key investors, alongside corporate backer Nippon Life Insurance.

Series C (September 6, 2019)

A subsequent Series C raised $9.8 million, bringing Moneyview’s valuation to $132 million. The company’s revenue grew to $8.3 million, with a multiple of 15.6x. Investors included Accel, Tiger Global Management, and Nippon Life Insurance.

Series D (September 23, 2021)

In Series D, Moneyview raised $1.1 million, at a valuation of $532 million. The company achieved revenue of $19.6 million, with a multiple of 27.1x. Key investors included DMI Sparkle Fund and Stride Ventures.

Series D (March 8, 2022)

Another Series D round raised $90.6 million, increasing Moneyview’s valuation to $591 million. The company posted revenue of $27.3 million, with a multiple of 21.7x. Leading investors included Tiger Global Management, Evolvence India, and Accel.

Series E (December 24, 2022)

Moneyview raised $75 million in a Series E round at a valuation of $900 million. The company’s revenue stood at $7.4 million, with a multiple of 120.9x. Investors included Apis Partners, Tiger Global Management, and Evolvence India, among others.

Conventional Debt (September 2, 2024)

In September 2024, Moneyview raised $29.8 million through Conventional Debt financing to continue its growth.

Series E-II (September 13, 2024)

In its latest funding round, Moneyview secured $4.7 million from Accel and Nexus Venture Partners, further boosting its financial capabilities. This round turned moneyview into a unicorn.

In terms of revenue, Moneyview has shown remarkable growth. Its operating revenue jumped 160% from ₹222 crore in FY22 to ₹577 crore in FY23. Even more impressive, its profit increased by 27X, going from ₹6 crore to ₹163 crore over the same period. (Entrackr)

A Unicorn Journey : From Big Ideas to Big Bucks

Moneyview is at the forefront of India’s digital lending revolution, offering personalized credit solutions to underserved segments of the population. The platform primarily focuses on providing instant personal loans, business loans, and credit tracking services through a fully digital, AI-driven process. Its innovative technology allows users to receive loans with minimal documentation, making it easier and faster for individuals to access credit.

Moneyview’s strength lies in its AI-powered credit risk assessment. Unlike traditional banks that rely on formal credit scores, Moneyview uses alternative data points like spending habits, utility bill payments, and even social media activity to assess the creditworthiness of applicants. This method has enabled the company to offer loans to individuals with limited or no formal credit history.

As Moneyview continues to scale, it is positioned to become an even bigger player in India’s growing fintech sector. The company’s ability to adapt to market demands and leverage partnerships ensures it remains a leader in providing innovative financial solutions.

What’s stopping you from turning your idea into the next unicorn like Moneyview? With the right strategy, dedication, and innovation, the possibilities are endless. If you’re hungry for more inspiration, check out our other insightful articles on Venture Kites. We cover startups, market trends, and innovative ideas that can help you refine your next big move.

At a Glance with DORK Company

Dive In with Venture Kites

Lessons From Moneyview

Leverage Technology to Scale

The Lesson & Why it matters: Technology allows businesses to scale quickly and efficiently. Using AI and machine learning, Moneyview processed loans faster and more accurately.

Implementation: Automate tasks that consume time, like customer service or processing, and use data analytics to make informed decisions.

How Moneyview implements it: They use AI to assess creditworthiness, speeding up loan approvals and making the process seamless for users.

Focus on Financial Inclusion

The Lesson & Why it matters: Expanding access to financial services can open up new market opportunities. Moneyview made it easy for people with no credit history to get loans.

Implementation: Tailor your products for underserved communities. Address their specific challenges with inclusive solutions.

How Moneyview implements it: Moneyview’s AI models evaluate non-traditional data sources like utility bills to offer loans to individuals without a credit history.

Data is King

The Lesson & Why it matters: Data-driven decisions result in more informed strategies. Moneyview’s data-centric approach helps assess risk and provide better loan products.

Implementation: Use analytics to track performance and identify growth opportunities. Prioritize metrics that matter most to your business model.

How Moneyview implements it: Their AI-driven model processes vast amounts of user data, helping to personalize loan offerings and predict risk.

Customer Trust is Key

The Lesson & Why it matters: Trust is everything, especially in finance. Moneyview built trust by offering transparent lending terms and prioritizing data security.

Implementation: Be transparent with your customers and focus on building long-term relationships based on trust.

How Moneyview implements it: With a secure app and clear communication about loan terms, Moneyview ensures customers feel confident in using their platform.

Adapt to Market Needs

The Lesson & Why it matters: Understanding the real needs of the market is critical for growth. Moneyview identified that millions of Indians lacked access to formal credit and acted on this gap.

Implementation: Conduct market research and address pressing issues your target customers face.

How Moneyview implements it: Moneyview created AI-driven credit solutions specifically for the underserved population in India, offering loans to those who traditional banks rejected.

Youtube Shorts

Author Details

Creative Head – Mrs. Shemi K Kandoth

Content By Dork Company

Art By Dork Company

Instagram Feed

X (Twitter) Feed

🚀 @KarbanTech is redefining indoor air quality with smart, eco-friendly bladeless fans! 🌬️💡

— Venture Kites (@VentureKites) November 4, 2024

Let’s dive into how they’re transforming the air we breathe and blending tech with design 👇👇#SmartHome #EcoTech #Karban