Fuel Finance : Rising from the Ashes of Ukraine to Fintech Titan

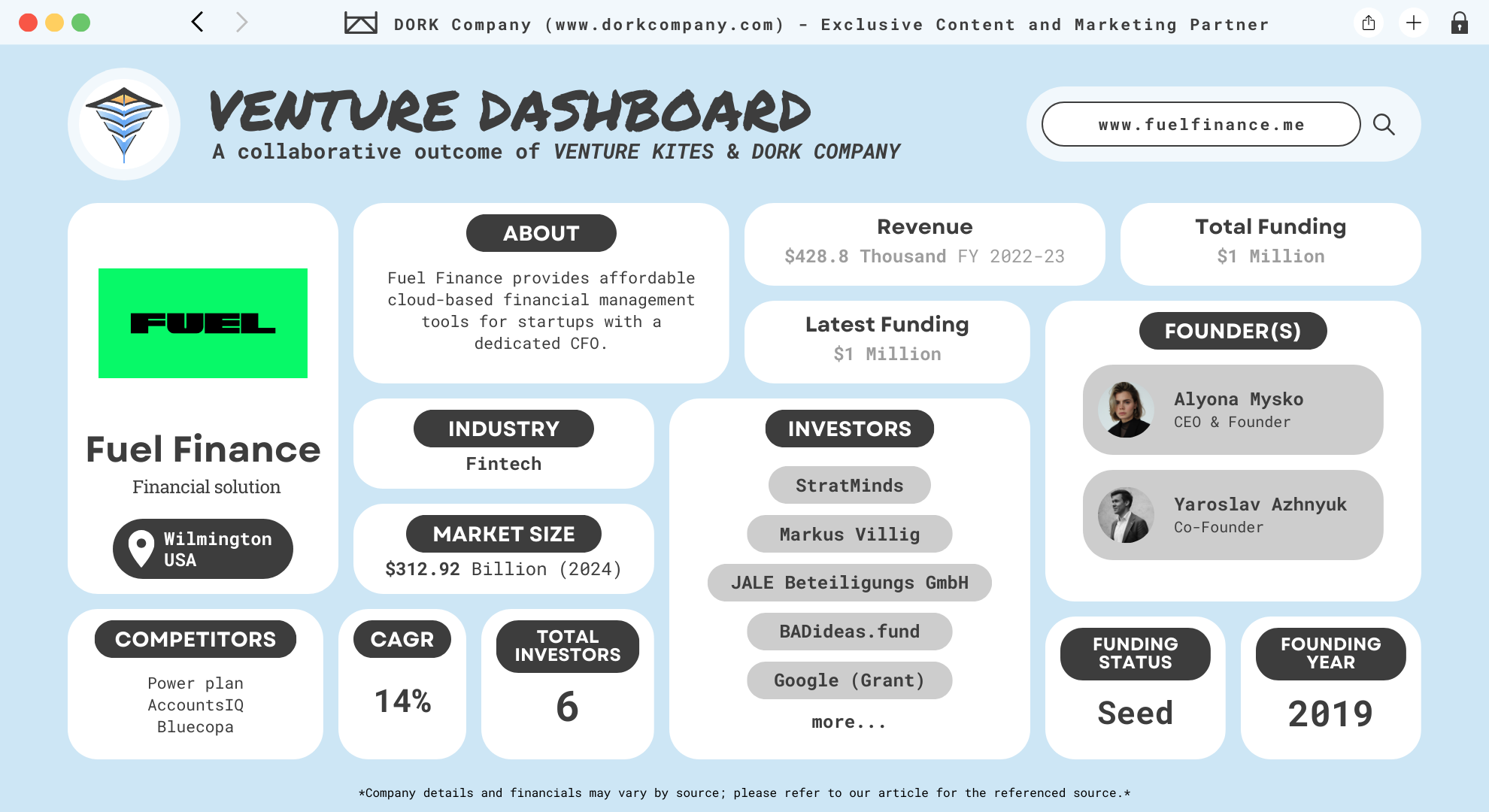

Feeling buried under piles of spreadsheets? Fuel Finance knows the struggle. This financial management startup is revolutionizing how small businesses and startups handle their finances, making things simpler and smarter. Founded in 2019 by Alyona Mysko and Yaroslav Azhnyuk, the company has its roots in Kyiv, Ukraine, but now serves businesses globally with headquarters in Delaware, US. With most of its team still based in Ukraine, Fuel Finance tripled its business in 2022 despite the Russian invasion.

Fuel Finance provides financial planning and analysis (FP&A) services specifically designed for fast-growing startups. Acting as a “fractional CFO,” they offer services that go beyond typical accounting software. From clean, insightful financial reports to AI-powered financial planning, Fuel Finance automates the manual grind, so startups can focus on growth. They integrate all your financial data in one place, create real-time dashboards, and even provide personalized financial strategies for each business with a dedicated CFO.

What sets Fuel Finance apart is their unique combination of automation and personal expertise. For startups struggling with cash flow, budgeting, or planning their next funding round, Fuel Finance steps in to provide clarity. Their solution is trusted by companies managing over $250 million in profit and loss (P&L), including notable names like Petcube and Lemon.io (Fuel Finance)

Two Founders, One Mission: To Keep Your Startup From Running on Empty

Starting a company during a war sounds like something out of a movie, but for Alyona Mysko and Yaroslav Azhnyuk, it’s a real-life success story. These two Ukrainian entrepreneurs co-founded Fuel Finance in 2019 with a shared mission to solve financial mismanagement in startups. Alyona, the CEO, had spent years working in finance, including at PwC, one of the world’s largest accounting firms. (Alyona Mysko)

Yaroslav met Alyona while seeking help to automate Petcube’s financial processes, and the two quickly realized they shared the same vision. His experience in growing Petcube helped him understand the importance of sharp financial management for startups. This made him the perfect co-founder to join Alyona in building Fuel Finance. (Yaroslav Azhnyuk)

Alyona’s love for numbers started early and took her from crunching numbers at school to earning a master’s degree in business and financial economics from the Kyiv School of Economics. After realizing the frustration that startups face with outdated financial systems, she partnered with Yaroslav Azhnyuk, who is also the CEO of Petcube, a popular tech company. Together, they envisioned Fuel Finance as a platform that could revolutionize financial management for startups by making it fast, efficient, and affordable.

Interestingly, Alyona’s passion for helping businesses goes beyond her startup. She has taken her expertise on the road, giving lectures and consulting with businesses on how to stay financially afloat even during crises. Her drive to bring financial literacy to the forefront has made her a well-respected figure in Ukraine’s startup ecosystem, earning her numerous speaking engagements, including TEDx Kyiv (Startups Without Borders Blog)

Just as Fuel Finance was finding its footing, the Russian invasion of Ukraine forced Alyona and her team to work from bomb shelters while continuing to grow the business. Fuel Finance didn’t just survive the war; it thrived, tripling its revenue and managing over $200 million in profit and loss for its clients by 2022.

Fintech Market : A Financial Revolution on Full Throttle

The fintech market has been on a rollercoaster in recent years, but 2024 is shaping up to be a critical year for innovation and growth. With a compound annual growth rate (CAGR) of over 14%, the global fintech market is expected to reach $608.35 billion by 2029, up from $312.92 billion in 2024. The key drivers for this surge include the rise of digital payments, increasing investment in fintech startups, and growing mobile wallet adoption. (Mordor Intelligence)

The shift towards open banking is revolutionizing how consumers interact with their financial data. In 2024, we can expect open banking frameworks to continue expanding, particularly in Europe and the U.S., giving consumers more control over their financial data through API-driven solutions. The European Union has led the charge with its PSD2 directive, and new updates, such as PSD3, aim to boost competitiveness and expand fintech’s reach even further.

The rise of embedded finance is also set to transform industries beyond banking, projecting a $320 billion market by 2030. Embedded finance integrates financial services into non-financial platforms, allowing businesses to offer seamless payment, lending, or insurance solutions to their customers (BCG Global).

In addition, the mobile payments market is booming. In 2024 alone, digital wallet transactions are forecasted to jump by 77%, with a total transaction value reaching $16 trillion by 2028. This growth is driven by consumer demand for faster, more secure payment options.

Despite economic headwinds, fintech remains one of the most exciting and resilient sectors, offering huge opportunities for startups to innovate in payments, lending, and data security.

Fuel Finance: More Than Just Financial Fuel, It’s a Full-Service Tune-Up

The platform’s goal is simple but ambitious: to prevent startups from going under due to poor financial management. According to CEO Alyona Mysko, 38% of startups fail because they run out of cash. Fuel Finance’s mission is to cut this statistic down by providing tools that replace cumbersome spreadsheets and help businesses make data-driven decisions.

The company envisions a future where startup founders spend less time worrying about financial chaos and more time growing their businesses. Their tools allow startups to streamline everything from bookkeeping to profit and loss statements and financial forecasting. This vision drives them to offer an accessible solution to startups that usually can’t afford traditional, costly financial management services.

Problems They Solve

Fuel Finance tackles several critical issues for startups. Many early-stage companies struggle with managing cash flow, making financial forecasts, and preparing investor reports. Fuel Finance solves these pain points with an intuitive, all-in-one platform that offers a dedicated CFO, financial dashboards, and real-time reporting.

Business Model

Fuel Finance’s business model is based on offering a subscription service tailored to early-stage startups and SMEs. The company provides affordable financial solutions that would typically cost startups thousands of dollars in traditional settings. Their pricing model starts at just $39 per month, making it accessible for companies that can’t afford to hire full-time financial teams. (Pricing)

The Full Package : Fuelling Up on Features and Ready to Roll

Fuel Finance provides a comprehensive, hands-on financial management solution designed to help startups grow efficiently and sustainably. With an intuitive platform designed for startups and SMEs, it offers powerful financial tools to keep your business on track. (Products)

Financial Statements and Reporting

Fuel Finance takes the hassle out of financial reporting. They provide automated and precise Profit and Loss (P&L) statements, Cash Flow reports, and Balance Sheets. These reports are updated monthly, ensuring you always have a clear picture of your financial standing without manually sorting through spreadsheets.

Dashboards and KPIs

The platform also offers customizable dashboards that provide real-time visibility into your key financial metrics. From revenue projections to detailed expense tracking, these dashboards help you monitor performance and make informed decisions. Tailored to each business, these KPIs are built to match your specific industry, whether you’re in SaaS, e-commerce, or professional services.

Financial Forecasting and Projections

Fuel Finance helps you plan for the future by providing two versions of financial forecasts based on your historical data and growth plans. Updated monthly or weekly, these forecasts help you understand best and worst-case scenarios and allow you to adjust your strategy accordingly.

Unit Economics

Understanding your Customer Acquisition Cost (CAC) versus Lifetime Value (LTV) is critical for scaling any startup. Fuel Finance’s unit economics tool lets you dig into these metrics to ensure sustainable growth. This feature is invaluable for managing campaigns and ensuring you are not overspending on acquiring new customers.

Plan vs. Actual Analysis

One of the standout features is the Plan vs. Actual Analysis. This tool compares your financial plans with real-world results, allowing you to refine strategies and improve precision. It’s a great way to stay on top of deviations from your expected financial performance.

Fractional CFO Support

Fuel Finance goes beyond software by providing access to a fractional CFO who offers expert financial advice, ensuring that even early-stage startups have access to seasoned financial professionals. This unique blend of software and human expertise sets Fuel Finance apart from traditional financial management tools.

Bootstrap by Fuel Finance

Bootstrap by Fuel Finance is the perfect solution for early-stage startups looking to gain control over their finances without the need for extensive financial knowledge. Bootstrap offers startups access to the “holy trinity” of financial reports: Profit & Loss (P&L), Cash Flow, and Balance Sheets. These reports provide essential insights into a startup’s financial health. Along with that, scenario-based financial planning allows startups to prepare for various business situations, giving them a clear roadmap to manage growth and financial challenges. (Bootstrap)

One of Bootstrap’s standout features is its Quickbooks integration, which automates data synchronization, reducing manual input and ensuring accurate financial records. Additionally, Bootstrap offers a comprehensive dashboard, which gives founders real-time access to their key financial metrics, all in one place.

The platform goes a step further with its financial literacy tools. It provides educational resources, including videos and tutorials, to help founders understand and navigate their financial data. Bootstrap comes in three tiers: a free version for manual input, a $39/month version integrated with Quickbooks, and a premium tier that offers a dedicated financial manager for $699/month.

Phenomenal Feats: Winning Big in the Startup World

Fuel Finance has made a significant impact in the startup ecosystem. The platform has managed over $250 million in client P&L, helping startups like Petcube, Reface, Saga, Reface and more increase profitability. Fuel Finance also snagged multiple awards, including the prestigious Golden Kitty Award from Product Hunt in 2022 for its impact on startups. It was ranked #1 on the platform as product of the day in both 2022 and 2024. (Product Hunt)

The company has also received several prestigious awards. In 2023, Fuel Finance earned the Capterra Best Value and Best Ease of Use awards, which speak to the platform’s affordability and user-friendly solutions. The company also shined on G2, securing the G2 High Performer Winter 2024 and G2 High Performer Europe 2024 awards, solidifying its reputation as a top-performing financial management tool globally.

Fuel Finance also actively collaborates with Lift99, a renowned startup community. Together, they’ve developed initiatives to support Ukrainian businesses affected by the war, including providing free financial consultations to small and medium-sized enterprises.

Fueled for the Future: $1M and Counting

Since its founding in 2019, the company has raised over $1 million across multiple funding rounds. The most significant funding event took place on January 24, 2023, when Fuel Finance secured $1M in a Seed round led by StratMinds and BADideas.fund, with prominent angel investors like Markus Villig (CEO of Bolt) and John S. Kim (CEO of SendBird) participating. (Tracxn)

Prior to this, Fuel Finance secured a grant from Google in 2022, further supporting its mission to revolutionize financial management for startups. As for revenue, Fuel Finance has seen steady growth, with revenue figures reaching $428.8K in 2023, a jump from $360K in 2022. (Latka SaaS Database)

Time to Refuel: Don’t Let Finances Stall Your Startup’s Growth

Fuel Finance has made a strong mark in the world of fintech by solving critical financial challenges for startups. Through their unique blend of AI-driven tools and dedicated CFO support, they’ve helped numerous companies streamline their financial processes. By simplifying cash flow management, forecasting, and financial reporting, they have ensured startups can focus on scaling without financial stress.

Fuel Finance’s affordable pricing model and user-friendly platform have made professional financial management accessible to early-stage businesses. This, combined with their social initiatives and resilience during crises, sets them apart as not just a company, but a partner to the startup ecosystem.

While you’re here, why not explore more insightful articles on Venture Kites? Discover how other innovative startups are solving big problems, and get inspired to kickstart your next big idea.

At a Glance with DORK Company

Dive In with Venture Kites

Lessons From Fuel Finance

The Power of Resilience

The Lesson & Why it matters: Resilience is the ability to keep going, even in difficult circumstances. It’s critical for startups facing uncertainty. Fuel Finance’s ability to continue growing during the war in Ukraine shows the strength of persistence.

Implementation: Build systems that allow your business to function under pressure. Ensure your team is adaptable and well-prepared for unexpected challenges.

How Fuel Finance Implements it: Despite operating in war conditions, Fuel Finance tripled its business in 2022 by adapting its tools to meet client needs.

Affordable Solutions for Startups

The Lesson & Why it matters: Offering affordable yet valuable services opens doors for early-stage companies. Fuel Finance’s subscription pricing starts at $999, accessible for many startups.

Implementation: Create a pricing model that aligns with your target audience’s budget, especially if you’re targeting smaller companies.

How Fuel Finance Implements it: Their pricing model is designed to help startups access financial services that would otherwise be out of reach.

Build Solutions For Automation

The Lesson & Why it matters: Automation saves time and reduces human error, allowing businesses to scale more efficiently. Fuel Finance uses automation to streamline financial reporting.

Implementation: Look for repetitive tasks that can be automated, and invest in technology that simplifies your workflow.

How Fuel Finance Implements it: Fuel Finance’s tools automate bookkeeping and cash flow management, making the process faster and error-free.

Adapt to Changing Markets

The Lesson & Why it matters: Flexibility allows companies to survive and thrive in volatile markets. Fuel Finance adapted its services to help Ukrainian SMEs during the war, showing their ability to pivot.

Implementation: Stay informed about market trends and adjust your offerings as needed.

How Fuel Finance Implements it: They launched new initiatives during the war, offering free consultations and crisis management tools.

Innovate with Customer Needs in Mind

The Lesson & Why it matters: Innovation should be customer-centric. Understanding your users’ needs and challenges will guide meaningful product improvements.

Implementation: Collect ongoing feedback from customers and build solutions that directly address their pain points.

How Fuel Finance Implements it: Fuel Finance continuously refines its financial management tools, adding features like financial forecasting and scenario planning based on customer feedback.

Author Details

Creative Head – Mrs. Shemi K Kandoth

Content By Dork Company

Art By Dork Company

Instagram Feed

X (Twitter) Feed

Founded by Alyona Mysko and Yaroslav Azhnyuk, Fuel Finance is redefining how startups manage their finances by offering cloud-based financial management tools with a dedicated CFO.https://t.co/wXUj47kLSI

— Venture Kites (@VentureKites) October 12, 2024

Proudly in collaboration with @dork_company – https://t.co/w7BPjtIdM3 pic.twitter.com/TpbBPGS8vI