Swish : How Sweden’s Mobile Payment Star Transformed Transactions

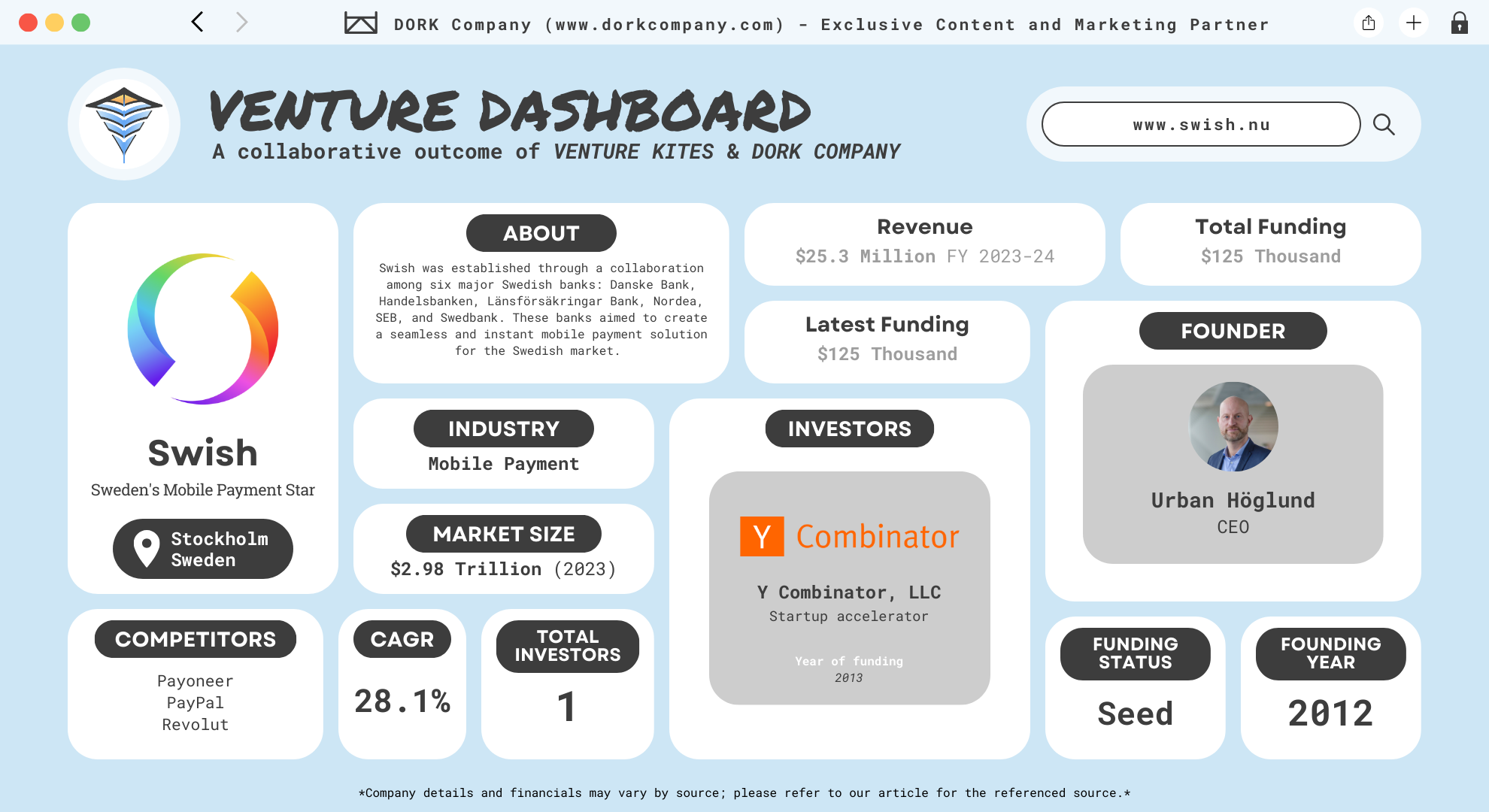

Swish is a mobile payment system in Sweden that allows users to send and receive money instantly using their smartphones. Launched in 2012, it has become a cornerstone of Sweden’s cashless society. Swish’s operations are managed by Getswish AB, headquartered in Stockholm, Sweden. (Swish)

Swish was established in 2012 through a collaboration among six major Swedish banks: Danske Bank, Handelsbanken, Länsförsäkringar Bank, Nordea, SEB, and Swedbank. These banks aimed to create a seamless and instant mobile payment solution for the Swedish market. The service operates through a smartphone application that links users’ phone numbers to their bank accounts, enabling real-time money transfers.

Swish facilitates instant payments between individuals and businesses. Users register their mobile numbers with their bank accounts and authenticate transactions using the BankID app, ensuring secure and swift payments. The service is available for iOS and Android devices, making it accessible to a wide range of users.

Since its inception, Swish has experienced significant growth in user adoption. As of July 2022, it had over 8 million users, covering a substantial portion of Sweden’s population of approximately 10.2 million.

Swede Dreams: How Six Banks Banded Together to Bank on Swish

Swish, Sweden’s leading mobile payment system, was launched in 2012 through a collaboration among six major Swedish banks: Danske Bank, Handelsbanken, Länsförsäkringar, Nordea, SEB, and Swedbank. These banks aimed to create a seamless and instant mobile payment solution for the Swedish market. The service was developed in cooperation with Bankgirot, Sweden’s central clearing house, and the Central Bank of Sweden (Sveriges Riksbank). (Wikipedia)

Before Swish, various mobile payment services existed but lacked widespread adoption due to fragmentation and limited interoperability. Recognizing this gap, the six banks collaborated to develop a system that would enable real-time, secure transactions between individuals and businesses across different banking platforms.

Urban Höglund

Urban Höglund is the current CEO of Swish (Getswish AB). Urban completed his education at Örebro University between 1991 and 1995. Before joining Swish, he held several leadership roles in prominent financial institutions and companies. (Urban Höglund)

At Handelsbanken, one of Sweden’s largest banks, Urban served in various capacities, including as Head of Cards and Mobile Payments and Head of Retail Payments. His tenure at Handelsbanken lasted over 15 years and contributed significantly to his expertise in card acquiring, mobile payments, and customer-oriented financial services.

Urban also worked with Ecster, where he was the Head of Product & Business Development as well as Head of Sales. Additionally, he served as a board member for VISA Sweden. In August 2021, Urban took on the role of CEO at Swish. Under his leadership, the company has continued to innovate, including the introduction of new payment functionalities like subscription services.

Payvolution: Riding the Wave of Digital Payments

The global mobile payment market has experienced remarkable growth in recent years, driven by the increasing adoption of smartphones, the expansion of e-commerce, and the demand for convenient, cashless transactions. In 2023, the market was valued at approximately USD 2.98 trillion and is projected to reach USD 27.81 trillion by 2032, exhibiting a compound annual growth rate (CAGR) of 28.1% during the forecast period. (Fortune Business Insights)

This rapid expansion is attributed to several factors, including the widespread availability of high-speed mobile networks and the growing penetration of smartphones, which have made mobile-based payment solutions more accessible to consumers worldwide. The digitalization of payment services and the growth of e-commerce businesses have further contributed to this trend, as consumers increasingly seek fast, secure, and convenient payment methods.

Regionally, Asia-Pacific has emerged as a dominant player in the mobile payment market, accounting for a significant revenue share in 2024. This dominance is due to factors such as rising smartphone penetration, evolving online shopping practices, and shifting consumer lifestyles. (Straits Research)

The COVID-19 pandemic has further accelerated the adoption of mobile payment solutions, as concerns about physical contact with cash led to a surge in contactless payments facilitated by mobile apps and digital wallets. This shift in consumer behavior has fostered a safer and more hygienic payment environment, leading to widespread acceptance and further growth of the mobile payment industry.

Mission Swish-able: Making Everyday Payments a Breeze

Mission and Vision

Swish’s mission is to make everyday life easier for individuals and businesses by providing a fast, secure, and convenient mobile payment solution. Its vision aligns with the broader goal of promoting a cashless society where digital payments replace traditional cash transactions.

Problems They Solve

The platform addresses critical pain points, such as the inconvenience of splitting bills, transferring funds instantly, and eliminating the need for carrying physical currency. It provides a seamless way for individuals to transfer money between accounts using only mobile numbers. For businesses, Swish offers an efficient solution to accept payments, whether in physical stores or online, eliminating delays and reducing transaction costs. The platform’s integration with BankID ensures that all transactions are secure and verified.

Business Model

Swish operates on a business model where private users enjoy free services, while businesses pay a small fee per transaction along with an annual subscription fee. This dual approach enables the platform to cater to diverse users while maintaining profitability. The infrastructure is open, allowing any organization that meets the legal and operational requirements to join, which has contributed to Swish’s wide adoption across Sweden.

Swish It Up: Features That Put Payments on Easy Mode

Swish is a widely adopted mobile payment system in Sweden, offering a range of products and features designed to facilitate seamless and secure transactions for both individuals and businesses.

Swish for Private Individuals

Swish enables private users to send and receive money instantly using their mobile phones. By linking their phone numbers to their bank accounts, users can transfer funds in real-time, making it ideal for splitting bills, sharing expenses, or gifting money. The service is free for private users, promoting widespread adoption across Sweden.

Swish for Businesses

Swish provides tailored solutions for businesses, allowing them to accept payments efficiently. Merchants can integrate Swish into their payment systems, enabling customers to pay using their mobile devices. This integration supports both in-store and online transactions, enhancing the customer experience and streamlining payment processes.

Swish for E-commerce

For online retailers, Swish offers a seamless payment option that can be integrated into e-commerce platforms. Customers can choose Swish at checkout, authenticate the payment through their mobile app, and complete the transaction instantly. This feature reduces cart abandonment rates and provides a secure payment method for online shoppers.

Swish QR Codes

Swish supports QR code payments, allowing businesses to generate unique QR codes that customers can scan to initiate payments. This feature simplifies the payment process, especially in physical retail environments, by reducing the need for manual input and minimizing errors. Businesses can create and display QR codes at points of sale, making transactions quicker and more convenient.

App-to-App Integration

Swish offers app-to-app integration, enabling businesses to embed Swish payment functionality directly into their mobile applications. This integration allows users to initiate and authorize payments within the business’s app, providing a seamless user experience and fostering customer loyalty.

Swish for Associations and Organizations

Non-profit organizations and associations can utilize Swish to collect donations or membership fees. By providing a Swish number or QR code, these entities make it easy for supporters to contribute, enhancing fundraising efforts and simplifying financial management.

Security Features

Swish prioritizes security by integrating with BankID, Sweden’s electronic identification system. This integration ensures that all transactions are authenticated and authorized by the user, protecting against fraud and unauthorized access. Additionally, Swish employs encryption and other security measures to safeguard user data and transaction information.

User-Friendly Interface

The Swish app features an intuitive interface, making it accessible to users of all ages. The straightforward design allows users to navigate the app effortlessly, view transaction history, and manage their accounts with ease.

Real-Time Transactions

One of Swish’s standout features is its ability to process transactions in real-time. Both the sender and receiver receive instant confirmation of the transaction, providing assurance and facilitating immediate access to funds.

Cost Structure

While Swish is free for private users, businesses and organizations incur a small fee per received payment and may be subject to an annual fee, depending on their bank’s terms. This pricing model makes Swish an affordable option for businesses of all sizes, from small enterprises to large corporations.

Swishing Through the Market: Awards and Accolades

As of 2022, over 80% of Swedes reported using Swish in the past month, a substantial increase from 52% in 2016. The service’s impact is particularly notable in peer-to-peer transactions and e-commerce. Swish has become the second most common payment method in online shopping, following debit cards. Its integration into e-commerce platforms has enhanced the convenience and speed of online transactions, contributing to the growth of digital commerce in Sweden.

The Riksbank’s 2022 survey revealed that only 34% of Swedes had used cash in the past month, a sharp drop from 79% in 2016. This trend underscores Swish’s role in promoting digital payments and reducing reliance on physical currency. (Sveriges Riksbank)

In 2013, just a year after its launch, it was named “Mobile Payment of the Year.” Its prominence continued to rise, and in 2021, Swish was honored as the “Strongest Brand in Sweden.” (Epicenter)

Teaming Up for Triumph: Swish’s Collaborative Conquests

Swish, Sweden’s leading mobile payment service, has established several strategic partnerships to enhance its offerings and expand its reach. In July 2024, Swish partnered with Zimpler, an instant payment solutions provider, to optimize payment processes for merchants. (Zimpler)

Swish is also a founding member of the European Mobile Payment Systems Association (EMPSA), established in 2019. This association fosters collaboration among European mobile payment providers, enabling cross-border mobile payments and promoting interoperability across different systems. EMPSA includes members from countries such as Austria, Belgium, Denmark, Finland, Germany, Italy, Norway, Poland, Portugal, Sweden, and Switzerland. (Wikipedia)

In the retail sector, Swish collaborated with Nets, a payment service provider, to pilot in-store mobile payments and integrate Swish payments into existing payment terminals, offering consumers a convenient and intuitive payment method in physical stores. The solution utilized Bluetooth technology to facilitate seamless transactions between customers’ mobile apps and merchants’ payment terminals. (Nets)

Making Cents of Swish: Funding a Future Without Cash

Swish, operated by Getswish AB, has achieved remarkable success as Sweden’s leading mobile payment system. The company secured its total equity funding of $125,000 in a single seed round in 2013. This funding round was led by Y Combinator, one of the most prestigious startup accelerators in the world. The seed funding played a crucial role in the early development and deployment of Swish. (Tracxn)

In 2023, the company’s net revenue was SEK 277 million ($ 25.3 Million), an increase from SEK 248 million in 2022. This growth represents a strong trajectory, driven by increasing adoption of its services across various sectors. (Swish Report 2023)

Swish operates under a consortium-based model, owned jointly by six of Sweden’s largest banks. This structure ensures that operational funding is sourced internally from its bank partners. Consequently, Swish has maintained a sustainable approach, reinvesting profits into innovation and expansion without relying on venture capital.

The company reported significant operational success in 2023, processing over 1 billion transactions valued at SEK 506 billion. Payments to businesses, organizations, and associations constituted 53% of these transactions, marking the first time business-related transactions surpassed peer-to-peer payments.

The company’s financial health is further highlighted by its profit margins and cash flow. For 2023, Swish reported an operating margin of 5%, reflecting efficient management and a solid return on investments.

The Final Swipe: Inspirations from Swish’s Success

Swish is a revolutionary mobile payment platform that has transformed how people and businesses handle financial transactions in Sweden. Launched in 2012 through a collaboration of six major Swedish banks, it provides a fast, secure, and user-friendly way to transfer money in real time. Whether you’re splitting a dinner bill with friends, shopping online, or running a business, Swish simplifies payments and reduces reliance on cash. With over 8 million users and billions of transactions processed annually, Swish has cemented its position as a leader in the digital payments industry.

Swish’s success story is a testament to the power of innovation, collaboration, and addressing real-world problems. By integrating cutting-edge technology like BankID for secure authentication and offering tailored solutions for private individuals, businesses, and organizations, Swish has set a high standard for the future of mobile payments. Its commitment to sustainability and operational excellence further enhances its reputation as a forward-thinking brand.

If Swish’s journey inspires you, now is the time to act on your ideas. The digital payment space and other tech-driven industries are ripe with opportunities for innovation. Finally, if you enjoyed learning about Swish’s story, there’s more to explore! Venture Kites offers a wealth of resources and articles on groundbreaking startups, innovation strategies, and success stories from around the world.

At a Glance with DORK Company

Dive In with Venture Kites

Lessons From Swish

Stay Ahead in Digital Innovation

The Lesson & Why it Matters: Staying ahead of digital trends keeps your business competitive. Swish embraced technologies like QR codes and app integration.

Implementation: Experiment with emerging technologies. Be prepared to pivot as digital tools evolve.

How Swish Implements It: Swish’s app-to-app integrations and QR code features cater to tech-savvy users looking for modern payment methods.

Adapt During Economic Shifts

The Lesson & Why it Matters: Economic changes demand agility. Swish thrived despite downturns in consumer spending and e-commerce slumps.

Implementation: Monitor economic trends and adjust your strategy. Diversify your offerings to appeal to varying market conditions.

How Swish Implements It: Swish increased its focus on business payments during economic slowdowns, driving growth in new segments.

Create a Recognizable Brand

The Lesson & Why it Matters: A strong brand identity helps build trust and familiarity. Swish’s simple name and logo are instantly recognizable in Sweden.

Implementation: Invest in branding that resonates with your audience. Maintain consistency across all communication channels.

How Swish Implements It: Swish’s branding emphasizes simplicity and reliability, aligning with its core service.

Turn Competitors into Partners

The Lesson & Why it Matters: Collaboration with competitors can lead to shared growth. Swish’s success stems from banks setting aside rivalry to build a joint platform.

Implementation: Seek partnerships where goals align, even with competitors. Prioritize long-term industry benefits over short-term gains.

How Swish Implements It: Swish’s founding banks collectively developed and funded the platform, demonstrating the value of cooperation.

Educate Your Market

The Lesson & Why it Matters: Innovative solutions often require education. Swish worked to ensure users understood its features and security protocols.

Implementation: Create clear, engaging tutorials and FAQ sections. Conduct workshops or webinars to explain your offering.

How Swish Implements It: Swish provided detailed guidance on using its app securely, helping users adopt the service with confidence.

Youtube Shorts

Author Details

Creative Head – Mrs. Shemi K Kandoth

Content By Dork Company

Art & Designs By Dork Company

Instagram Feed

X (Twitter) Feed

🚀 Discover how @getswish is revolutionizing payments in Sweden and setting the stage for a cashless future! 💸

— Venture Kites (@VentureKites) December 9, 2024

Let’s break down Swish’s journey, from a six-bank collaboration to becoming the leading mobile payment platform for 8+ million users. 👇👇#MobilePayments #Swish