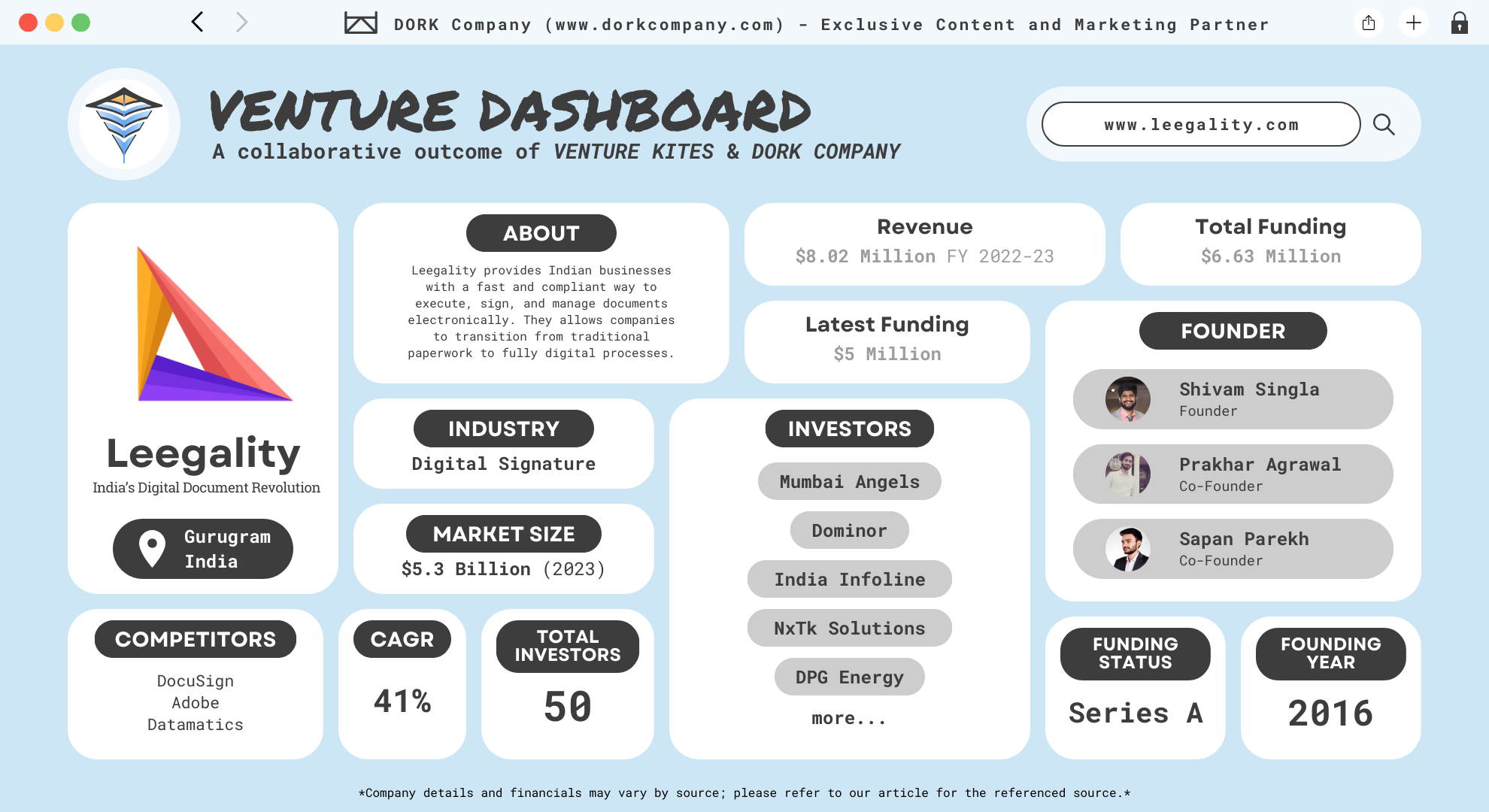

Leegality : Signing Off on India’s Digital Document Revolution

Leegality, founded in 2016, is a Gurugram-based legal tech startup revolutionizing document management in India. Founded by Shivam Singla, Prakhar Agrawal, and Sapan Parekh, Leegality provides Indian businesses with a fast and compliant way to execute, sign, and manage documents electronically. With headquarters in Gurugram, Haryana, the platform is particularly valuable in industries requiring high compliance, such as banking, legal, and finance, allowing companies to transition from traditional paperwork to fully digital processes. (Leegality)

The platform specializes in digital signatures (eSign) and electronic stamps (eStamp), addressing India’s unique legal compliance needs. Leegality’s solution integrates with the Information Technology Act of 2000, making eSignatures legally binding and reliable. Its infrastructure not only allows businesses to sign and stamp documents but also prevents fraud through advanced security features, including GPS-based location restrictions and two-factor authentication.

Since its inception, Leegality has seen rapid adoption by several Indian businesses, including major banks like ICICI and HDFC. This high adoption rate shows the demand for compliant digital transformation in India’s business ecosystem. By supporting digital paperwork at scale, Leegality is streamlining document logistics, saving time, and reducing operational costs.

Turning Paper into Pixels : The Masterminds Behind the (e)Signature Move

Leegality was founded in 2016 by Shivam Singla, Prakhar Agrawal, and Sapan Parekh. Their vision was to simplify and secure document processes in India’s highly regulated industries, particularly where paper-based processes were slow and error-prone.

Shivam Singla

Shivam Singla is the CEO and has a B.A., LL.B. (Hons.) from the prestigious National Law School of India University. This legal education provided him with a solid foundation in technology law, an area he explored further during his time at Poovayya & Co., Advocates & Solicitors, where he worked on issues in technology law for leading e-commerce clients. Beyond Leegality, Shivam’s career includes experience as a Product Adviser at DayBox Technologies, a SaaS platform for restaurant supply chain management. (Shivam Singla)

Prakhar Agrawal

Prakhar Agrawal is a co-founder and Head of Technology at Leegality. Since joining Leegality in August 2017, Prakhar has led its technical development. He holds a Bachelor of Technology in Computer Science from Krishna Institute of Engineering and Technology, Ghaziabad. Prakhar’s technical expertise includes a robust foundation in programming languages and frameworks like Groovy, Spring Boot, Linux, Grails, and Java. Before Leegality, Prakhar worked in various roles such as Member of Technical Staff at Innovaccer, a health-tech company and as a Software Engineer at TO THE NEW. Additionally, Prakhar led development at EximBook, an innovative import-export marketplace. (Prakhar Agrawal)

Sapan Parekh

Sapan Parekh is a co-founder who joined Leegality in August 2018. Before Leegality, he served as an Associate in the Competition Team at Shardul Amarchand Mangaldas from July 2016 to July 2018, specializing in competition law. His work included managing merger control cases and antitrust litigation for major clients, particularly within the radio taxi service and other sectors. Sapan studied law at the National Law School of India University, with an exchange program at the National University of Singapore. He has been recognized for his excellence in legal studies and has won several awards, including the Pan-Asian Award at the Willem C. Vis International Commercial Arbitration Moot, where his team earned commendations for their legal memoranda. (Sapan Parekh)

The Founding Story

The founding team recognized a significant gap in India’s digital document management landscape, where businesses, especially in finance and legal sectors, faced delays and regulatory challenges with physical documentation. Their goal was to create a platform that could handle the country’s strict compliance requirements while ensuring easy integration for businesses. Leegality’s platform now supports digital signatures, e-stamping, and secure document workflows, becoming an indispensable solution for over 2000 Indian companies across banking and financial sectors.

A Market with the Write Stuff – Global Demand for Digital Signatures Skyrockets

The global digital signature market is experiencing rapid growth as businesses and governments prioritize secure digital transactions. In 2023, the market size was valued at around USD 5.3 billion, and it is expected to grow significantly. Projections estimate it will reach between USD 118.8 billion by 2032, with an impressive compound annual growth rate (CAGR) of about 41% from 2024 to 2032. (Fortune Business Insights)

This growth is driven by the increasing adoption of digital signatures across sectors like banking, finance, real estate, and government. Security and compliance remain top priorities, especially with new regulations in regions like Europe, where the eIDAS regulation mandates secure digital transaction standards. North America is currently a leading region due to its early adoption and regulatory support, while Asia-Pacific is expected to experience the fastest growth due to digitalization initiatives in countries like India and China. (Straits Research)

The digital signature market benefits from advancements in cloud technology, allowing more scalable and accessible solutions. Cloud deployment, in particular, is anticipated to dominate due to its flexibility and integration ease. By enhancing security protocols and supporting compliance with laws, the market addresses rising cybersecurity concerns, further fueling demand.

Signed, Sealed, and Digitally Delivered – Leegality’s Mission to Modernize Indian Documentation

Mission and Vision

Leegality’s mission is to transform India’s documentation process into a seamless digital experience. Their goal is to eliminate the inefficiencies, costs, and delays that physical paperwork imposes on businesses, especially in compliance-driven industries. The company envisions a paperless business ecosystem in India, where secure, compliant, and efficient digital processes replace outdated manual documentation. (About Leegality)

Problems They Solve

Leegality addresses several critical issues faced by businesses in document handling. Traditional paperwork is costly, time-consuming, and prone to errors. For regulated industries like banking, insurance, and legal services, compliance and security are paramount. Leegality’s digital infrastructure helps companies streamline document execution, reducing turnaround times and lowering costs. They provide secure, legally compliant digital tools that enable companies to manage documentation and verification needs effortlessly. With services like eSign, eStamp, and document fraud prevention, Leegality empowers businesses to operate faster and more securely.

Business Model

Leegality operates on a SaaS model, offering subscription-based solutions that suit businesses of all sizes, from small enterprises to large corporations. Their B2B and B2B2C business models provide flexibility for different organizational needs, enabling integration with existing workflows through robust APIs. Leegality’s platform supports scalability, allowing companies to add features as they grow. This approach positions Leegality as a one-stop digital infrastructure provider for businesses looking to optimize their document management with compliant and efficient digital solutions.

Signing Up for Success – Leegality’s Suite of Tools

Leegality’s core offering is its Document Execution Platform, which enables Indian businesses to digitize every aspect of paperwork, from signing to stamping and managing document workflows.

Their key offerings include:

BharatSign

BharatSign is a comprehensive eSignature solution tailored for Indian businesses, supporting over 15 different eSign methods. It enables organizations to deploy large-scale eSign workflows within 30 days, minimizing IT/tech requirements. Thei key features include:

- Automatic Fallback Mechanisms: Ensures uninterrupted eSign processes by rerouting to the best available eSign Service Provider (ESP) when there are downtimes, and provides alternatives for OTP and biometric-based eSignatures.

- Regulatory Compliance: The feature adheres to Indian legal standards, offering built-in solutions for stamping and fraud prevention without extra implementation.

- Multilingual Interface: Supports 11 Indian languages and allows sending of eSign links via WhatsApp to increase accessibility and usability. (BharatSign)

BharatStamp

BharatStamp is a legally compliant digital stamping solution available across 31 Indian states and union territories, facilitating digital document stamping through either Leegality’s in-house system or NeSL. Key features include:

- Digital Revenue Stamping: BharatStamp’s unique digital revenue stamping process allows for the complete digitization of Demand Promissory Notes (DPNs) without physical paperwork.

- Stamp Reuse: In cases where signers drop off, BharatStamp allows organizations to reclaim unused stamp paper, reducing stamp wastage and saving costs.

- Centralized Stamp Inventory: The Leegality Dashboard provides centralized management for digital stamp inventory, enhancing operational efficiency and eliminating physical stamp logistics. (BharatStamp)

Paperwork Operations

This feature focuses on digitizing operational paperwork, providing tools for seamless internal communication and streamlined workflows. Key components include:

- Reviewer Roles and Notifications: Documents can be assigned to internal reviewers, and key stakeholders (like sales or legal teams) can receive automated notifications to ensure all parties are informed and engaged.

- Digital Rubber Seals and Reference Numbers: Enables digital rubber seals on documents and assigns internal reference numbers for easy document retrieval.

- Secure Storage and Download Options: Signed documents are securely stored with options for secure downloading to internal servers without API integration, and documents can be automatically purged from Leegality’s servers after signing. (Paperwork Operations)

Document Fraud Prevention

Leegality offers an advanced fraud prevention suite powered by AI to ensure document authenticity and regulatory compliance. Key fraud prevention measures include:

- Aadhaar eSign Verification: Prevents fraudulent Aadhaar-based signing by verifying the Aadhaar holder’s identity.

- Face Match: Uses AI to verify the signer’s face during eSign, ensuring the correct person is signing the document.

- Geofenced eSign: Limits eSign activity to authorized locations, such as specific company branches.

- Secure Audit Trails: The system provides tamper-proof audit trails that include IP logging and timestamping, aiding in regulatory audits and legal verification. (Fraud Prevention)

Plug and Play Dashboard

The Leegality dashboard offers a user-friendly, no-code configuration environment that empowers business and product teams to handle digital document flows independently of IT teams. Features include:

- Workflow Configuration: Users can set up workflows that manage signing types, stamp requirements, and security features in minutes using the dashboard interface.

- Bulk Signing Capability: A centralized team can initiate thousands of signing workflows simultaneously through Excel file uploads, enabling efficient high-volume document processing.

- API Integrations: For organizations needing API-level customization, the platform allows a simple, one-time integration using a unique workflow ID, streamlining deployment with minimal tech intervention. (Plug and Play Dashboard)

NeSL Integration

NeSL (National e-Governance Services Ltd) is India’s Information Utility, enabling financial institutions to submit electronic documents for authentication and storage. Leegality’s NeSL Suite offers seamless integration for banks and NBFCs, providing an enterprise dashboard that enables quick, code-free setup, streamlining electronic document authentication and submission processes. Features include:

- Smart API Integration: Leegality’s API reduces integration time and cost by offering video and text-guided journeys for borrowers and supporting NeSL’s comprehensive digital stamping across 25+ states.

- Enterprise Dashboard: Allows for instant sending of multiple NeSL invites, monitoring of document journeys, reminders, notifications, and MIS report generation, all centrally managed.

- Fraud Prevention: Incorporates eSign Certificate Verifier, ensuring borrowers authenticate documents with their own Aadhaar/DSC, significantly reducing fraud risk. (NeSL Integration)

Signer Verification

Signer Verification in Leegality ensures document authenticity and compliance with Indian IT laws by verifying digital signatures on uploaded documents.

- Digital Signature Verifier: Users can upload PDF documents (up to 25 MB) to Leegality’s verifier, which checks the validity of signatures based on standards established by the Indian IT Act, 2000.

- Verification Features: Verifies that the digital signatures are linked to an authorized Aadhaar or DSC (Digital Signature Certificate), ensuring that the signer is legitimate and that the document hasn’t been tampered with.

- Secure Verification Platform: The verifier is accessible through a secure web interface, enabling users to validate documents conveniently without the need for software installation. (Signer Verification)

Branding and Customization

Branding and Customization features allow businesses to personalize the eSign experience, creating a document workflow that reflects their brand identity and enhances customer trust.

Key Features:

- Brand Colors and Logo: Users can set brand-specific colors and logos in the Leegality workflow, ensuring a consistent visual experience across documentation.

- Custom Domains and Multilingual Support: Businesses can send document invites from their company’s domain and offer eSign flows in 10 Indian languages, making the process accessible to a broader audience.

- Custom Consent Fields: Additional custom consent requests can be integrated with the standard eSign consent, allowing companies to capture specific approvals in compliance with internal or regulatory requirements.

- Dashboard Customization: The Leegality dashboard can be modified to align with a business’s branding preferences, enabling users to navigate a visually cohesive document management system. (Branding and Customization)

Paperwork Analytics

Paperwork Analytics provides insights into document execution processes, enabling companies to track, analyze, and boost their document workflow ROI.

Key Features:

- Automated MIS Reports: Customizable, automated reports can be scheduled daily, weekly, or monthly, providing an overview of conversion rates and eSign/eStamp consumption.

- Real-time Activity Logs: Access live logs that track document status and pinpoint user drop-offs, offering insights into operational inefficiencies.

- Quarterly ROI Review: Offers detailed ROI reports based on Leegality’s real-time data, helping organizations assess the performance and cost-effectiveness of digital document implementation. (Paperwork Analytics)

Consent Blog

The Consent Blog is an informative resource by Leegality that provides insights on consent under the Digital Personal Data Protection (DPDP) Act, helping businesses understand and comply with India’s emerging data protection regulations.

Key Content:

- In-depth comparisons between DPDP and GDPR, regular updates on DPDP-related topics, and practical compliance tips for Indian businesses.

- Features posts on data rights, consent management practices, and compliance for various industries, making it a valuable resource for data privacy and protection guidance. (Consent Blog)

Consent Manager

Consent Manager is Leegality’s tool for collecting, storing, and managing user consent in compliance with the DPDP Act. It allows businesses to integrate a configurable consent UI across multiple touchpoints, ensuring compliance with consent requirements.

Technical Features:

- Centralized Consent Storage: Consolidates all consent records in one place, creating immutable and verifiable logs that comply with legal standards.

- Data Principal Rights Management: Manages requests related to data subject rights, including consent revocation, right to be forgotten, and data portability.

- DPDP Compliance Enforcement: Onboards third-party systems to enforce DPDP-compliant practices, enabling organizations to monitor and manage compliance across their network. (Consent Manager)

Data Retention Guide

Leegality’s Data Retention Guide provides a clear framework for data retention as per DPDP law, ensuring businesses understand sector-specific requirements for data storage and deletion.

Key Features:

- Retention Timelines: Provides infographics and detailed timelines on data retention requirements tailored to sectors like finance, healthcare, telecom, and general employment.

- Compliance Software Access: Early access to compliance software that helps businesses adhere to data retention guidelines with minimal effort. (Data Retention Guide)

A Byte of Innovation – Tech That’s Securing Every Signature

Leegality uses advanced technology and secure protocols to ensure that digital document transactions are legally compliant, secure, and efficient. Their core technology integrates Public Key Infrastructure (PKI) to create secure, legally binding digital signatures. Here’s a breakdown of the main technologies that power Leegality.

Digital Signatures Using PKI

Leegality’s digital signature process operates on PKI, which uses a combination of private and public keys to authenticate signers. When a user signs a document, Leegality generates a hash (unique identifier) of the document, which the user encrypts with their private key, forming the digital signature. The recipient uses the public key to decrypt this hash, confirming the document’s authenticity. Any changes to the document would invalidate the signature, ensuring data integrity throughout the signing process. This protocol not only makes digital signatures secure but also legally binding under the Information Technology Act.

Document Security Protocols

Leegality incorporates multiple layers of security to prevent unauthorized access and ensure document integrity. Features like Aadhaar/DSC verification, geolocation capture, and face capture safeguard each document. Geolocation ensures that documents are signed in approved locations, while face capture records the signer’s presence, further reducing risks of fraud or misrepresentation. Leegality’s two-factor authentication adds an additional layer, requiring users to authenticate their identity before accessing sensitive documents.

Geofencing and IP Restrictions

Geofencing is another critical technology that restricts access to specific geographical locations, which is especially useful for high-security transactions. IP restrictions enforce where and how documents can be accessed, helping businesses manage document access securely, even for remote workflows. This IP-level security prevents unauthorized access from restricted locations, ensuring data security no matter where users are located.

Real-Time Fraud Detection and Verification

Leegality’s Verifier API allows companies to validate signed documents in real time, checking details such as certificate validity, certificate chain, and timestamps. This API detects any signs of tampering, confirming the identity of the signer through data cross-verification like name, address, and other identifiers. With fraud detection mechanisms like face capture and geolocation, Leegality ensures that only verified individuals can sign documents

Impact Partners – Leegality’s Power Moves in the Paperless Revolution

Leegality has gained significant recognition for its contributions to the digital and legal-tech landscape in India, particularly for its efforts in digitizing and securing document workflows. Since its founding, the company has become integral to over 2000 Indian businesses, including major financial institutions like ICICI Bank, HDFC, and Airtel Payments.

One of its most impactful collaborations is with National eGovernance Services Limited (NeSL). This government-backed organization acts as India’s first and only Information Utility (IU) under the Insolvency and Bankruptcy Code (IBC), providing a secure platform for storing debt-related information.

By integrating with NeSL, Leegality enables banks and non-banking financial companies (NBFCs) to streamline debt documentation, ensuring faster and more compliant debt-related workflows. This integration gives Leegality clients access to NeSL’s Digital Document Execution (DDE) and Information Utility Service Ecosystem, enhancing transparency and accelerating insolvency proceedings.

Leegality also collaborates with major financial institutions, including HDFC Ltd, South Indian Bank, Airtel Payments Bank, and ICICI Bank. For instance, South Indian Bank partnered with Leegality to digitalize its home loan documentation. Similarly, HDFC and Airtel Payments Bank use Leegality’s solutions to streamline their documentation processes, enhancing compliance and reducing the need for physical paperwork.

Funds and Forward Motion – How Leegality’s Backers Fuel Its Growth

Leegality has secured substantial funding to fuel its growth in India’s legal-tech sector. Since its founding, the company has raised a total of approximately $6.63 million across several funding rounds. (Tracxn)

June 4, 2019 – Seed Round

Leegality’s first funding came in June 2019 through a seed round of $361,000 at a valuation of $1.6 million. This initial funding round, facilitated by institutional investors like Mumbai Angels and Chandigarh Angels Network, alongside various angel investors, marked Leegality’s official entry into the digital documentation market. With this capital, Leegality reported revenue of Rs 82.5 lakh in its early stages.

July 5, 2021 – Second Seed Round

In July 2021, Leegality raised $1.3 million in a second seed round, reaching a valuation of $14.7 million. Notable investors included Mumbai Angels, Dominor, IIFL Fintech Fund, and various corporate investors like India Infoline and Anjana Software Solutions. By this time, Leegality’s revenue had grown to Rs 1.1 crore. This round allowed the company to further develop its digital solutions for document automation and e-stamping.

October 18, 2022 – Series A Round

In October 2022, Leegality achieved its largest funding milestone by raising $5 million in a Series A round, elevating its valuation to $37 million. This round included investments from IIFL Fintech Fund, Mumbai Angels, and corporate backers like Equisearch. The capital was used to accelerate customer acquisition and enhance product capabilities. In the fiscal year following this investment, Leegality’s revenue soared to Rs 35.5 crore.

Leegality’s revenue trajectory showcases significant growth. From Rs 82.5 lakh in FY 2019-20, it rose to Rs 66.4 crore by FY 2023-24. This growth reflects Leegality’s increasing market adoption among Indian businesses, particularly in the banking, finance, and insurance sectors.

Ink-credible Inspiration – Leegality’s Journey to Paperless Success

Leegality has transformed how Indian businesses handle document workflows, making the shift from paper-based processes to seamless, digital operations. With powerful tools like eSign, eStamp, and automated document workflows, Leegality enables companies to complete essential tasks faster, more securely, and in compliance with regulatory standards. Its partnerships with financial giants and collaborations with regulatory bodies like National eGovernance Services Limited (NeSL) underscore its importance in India’s legal and financial ecosystems

From its inception, Leegality has helped businesses overcome traditional paperwork hassles, boosting productivity and cutting operational costs. With each innovation, Leegality sets new standards for digital documentation, making secure, compliant transactions accessible to all.

If you have a vision for transforming traditional systems or enhancing business efficiency, let Leegality’s story inspire you to take action. Start planning and refining your own ideas, and make the first steps toward bringing them to life. And, if you’re interested in more stories like this, check out other profiles and insights on Venture Kites.

At a Glance with DORK Company

Dive In with Venture Kites

Lessons From Leegality

Integrate with Regulatory Bodies Early

The Lesson & Why It Matters

Building compliance-based integrations early aligns your business with regulatory standards, reducing future legal challenges.

Implementation

Research relevant regulatory bodies and proactively reach out to establish compliant integrations or partnerships.

How Leegality Implements It

Leegality partnered with NeSL to ensure seamless integration with India’s regulatory framework, a move that strengthened its position in the compliance-heavy finance sector

Balance Tech and Practical Usability

The Lesson & Why it Matters:

Technology should prioritize user practicality, especially in high-stakes environments. Balancing functionality with ease of use ensures adoption and effectiveness.

Implementation:

Design interfaces that are intuitive and useful for your target audience, considering factors like environment, safety, and ease of access.

How Proxgy Implements it:

Proxgy designed its SmartHat with simple controls, durable materials, and ergonomic features, making it practical for industrial workers under harsh conditions

Design for Scalability from Day One

The Lesson & Why It Matters

Designing scalable processes from the start ensures that growth doesn’t overwhelm operations.

Implementation

Use modular technology solutions and adopt SaaS models that make it easy to scale operations as demand increases.

How Leegality Implements It

Leegality’s low-code APIs and plug-and-play dashboard allow new clients to integrate without heavy customizations, supporting scalable onboarding

Focus on Cash Flow Over Valuation

The Lesson & Why It Matters

Managing cash flow over chasing high valuations keeps businesses sustainable, especially in uncertain economic conditions.

Implementation

Optimize your pricing model and focus on customer acquisition and retention to maintain positive cash flow.

How Leegality Implements It

Leegality’s subscription-based pricing and efficient cash flow management turned it profitable, even as it scaled

Focus on Operational Efficiency

The Lesson & Why It Matters

Operational efficiency improves scalability and customer satisfaction. Leegality uses automation to streamline document processes.

Implementation

Automate repetitive tasks to reduce human error and enhance speed.

How Leegality Implements It

Leegality’s automated document workflows save clients time and eliminate manual errors

YouTube Shorts

Author Details

Creative Head – Mrs. Shemi K Kandoth

Content By Dork Company

Art By Dork Company

Instagram Feed

X (Twitter) Feed

🚀 @leegality is an Indian digital documentation platform that provides secure, compliant, and efficient solutions for electronic document management.📄

— Venture Kites (@VentureKites) November 14, 2024

Let’s dive into how they’re reshaping paperwork in compliance-heavy sectors.👇👇 #LegalTech #DigitalTransformation