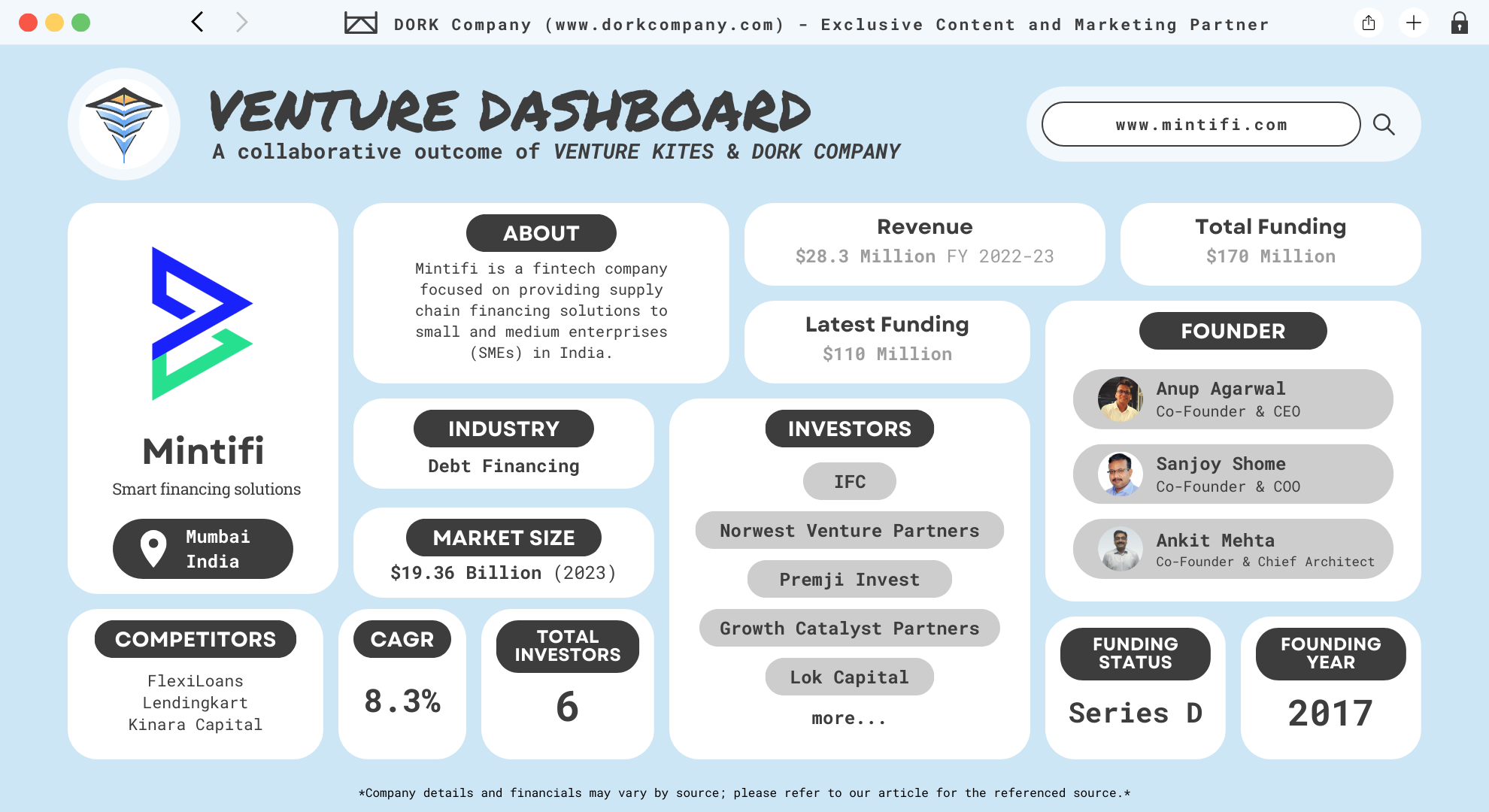

Mintifi : The Untold Story Behind Their $110M Payday

Need a smart way to finance your business? Mintifi has you covered! Founded in 2017 by Anup Agarwal, Sanjoy Shome, and Ankit Mehta, Mintifi is a Mumbai-based startup that simplifies supply chain debt financing for small and medium enterprises (SMEs). By providing businesses with fast, flexible, and tailored financing options, Mintifi has helped countless companies optimize their cash flow without the hassle of traditional bank loans. (Mintifi)

So, what is debt financing? Simply put, it’s when a company borrows money and agrees to pay it back later, usually with interest. This could come in the form of loans, bonds, or credit lines. The key advantage of debt financing is that the borrower doesn’t have to give away ownership or control of the company. Instead, they repay the borrowed funds over time.

Anup Agarwal, along with his team, saw a massive gap in the Indian credit market. Small and medium-sized enterprises (SMEs) were finding it difficult to secure timely credit from traditional lenders, which often came with a lot of red tape.

Mintifi solves the liquidity issues that SMEs frequently face, especially when dealing with lengthy payment cycles. Their platform automates and accelerates credit approvals. This means that businesses can get the credit they need to buy inventory, cover operating expenses, or even invest in growth—all without drowning in paperwork or delays. From their roots in Mumbai, Mintifi has expanded rapidly, working with over 100 brands and facilitating transactions worth hundreds of crores.

The Brains Behind Mintifi : From Bankers to Game Changers

You wouldn’t believe it, but Mintifi started with rejection—lots of it. Anup Agarwal, one of the co-founders, faced 20 rejections when trying to raise $2 million for his startup. But that didn’t stop him. Alongside Sanjoy Shome and Ankit Mehta, they launched Mintifi in 2017 in Mumbai, India. Today, the company has completely changed how supply chain financing works in India. (Forbes India)

Anup Agarwal

Anup Agarwal, the co-founder and CEO of Mintifi, has a strong background in investment banking and finance. He is a qualified Chartered Accountant and previously served as the Managing Director and Head of Technology, Media, and Telecom (TMT) for Jefferies Investment Bank, covering India and Southeast Asia. His career spans over two decades, during which he successfully managed mergers and acquisitions, fundraising, and private equity transactions amounting to over $15 billion. Before that he served as a Vice president at Kotak Investment Banking. (Anup Agarwal)

Sanjoy Shome

Sanjoy Shome is a Co-Founder and the Chief Operating Officer (COO) at Mintifi. With over two decades of experience in risk, credit, operations, and sales, Sanjoy has played a pivotal role in driving Mintifi’s growth. Sanjoy’s career before Mintifi includes leadership roles across various financial services organizations. Notably, he was the COO and Head of Risk at NeoGrowth. His previous experience spans top companies such as Fullerton, Standard Chartered, and Tata Capital. (Sanjoy Shome)

Ankit Mehta

Ankit Mehta is a Co-founder and the Chief Architect. Before Mintifi, Ankit had a successful career in the tech industry. He holds a strong background in management and technology, which has helped him architect Mintifi’s innovative financial platforms. He is a serial entrepreneur and before co-founding Mintifi, he co-founded Audience73 and slickmart. He also has a master’s degree in chemistry from IIT Bombay. (Ankit Mehta)

Their idea behind Mintifi was simple but revolutionary—provide tailored financing solutions for small and medium-sized enterprises (SMEs) in India. Since traditional financing was too slow and rigid, they aimed to fill this gap with a faster, more flexible approach using technology.

Borrow Big, Grow Bigger: The Power of Debt Financing

Looking to understand where the money comes from for businesses? The debt financing market is booming and shows no signs of slowing down. In 2023, this market was valued at approximately USD 19.36 billion, with expectations to grow at a compound annual growth rate (CAGR) of 8.3% until 2032, reaching USD 40.46 billion. (Expert Market Research)

Debt financing is a broad term that refers to companies borrowing money from lenders, with a promise to repay the principal plus interest at a later date. It’s commonly done through bank loans, bonds, debentures, or other financial instruments. The appeal of debt financing over equity is simple—companies retain full ownership, and loans often come with tax benefits. However, the repayment pressure can be significant.

Key Trends and Market Dynamics

The global debt financing market has shown robust growth due to increasing demand for capital from startups and expanding businesses. Interestingly, the North American market, particularly the U.S., holds a commanding 45.2% share of the global market. This dominance is due to the U.S.’s established banking industry, liquid capital markets, and a stable regulatory environment.

Global Outlook

Regions such as Asia-Pacific and Europe are emerging as major contributors to the market, driven by the rise in business expansions and industrial developments in these areas. Moreover, interest rate fluctuations in global markets have also influenced the demand for debt instruments.

Minting a New Way: The Business Model with a Golden Touch

Mintifi’s mission is to empower small and medium enterprises (SMEs) by providing seamless and flexible supply chain financing solutions. Launched in 2017, Mintifi addresses a critical problem in India’s financial ecosystem—SMEs often struggle to access credit from traditional banks due to their size and lack of collateral. By leveraging data-driven tools and technology, Mintifi makes the lending process faster, more transparent, and more accessible.

Vision

Mintifi aims to revolutionize how SMEs manage cash flow by creating a financial ecosystem where businesses can grow without worrying about delayed payments or complex loan processes. The company envisions a future where supply chain financing is simplified, with embedded financial solutions tailored to every business’s unique needs.

Problems They Solve

Traditional lending institutions are hesitant to extend unsecured loans to SMEs, making it difficult for these businesses to maintain steady working capital. Mintifi fills this gap by offering unsecured loans, allowing businesses to manage their cash flow, purchase inventory, and cover operating costs with ease. Their solutions are designed to reduce inefficiencies in the order-to-cash cycle, ultimately enabling businesses to grow without being constrained by working capital.

Business Model

Mintifi operates a B2B supply chain financing model, providing flexible financing to SMEs through partnerships with larger corporate entities. By offering revolving credit lines, purchase credit, and other tailored financial solutions, Mintifi helps businesses maintain liquidity. The company’s model is anchored in providing short-term loans that typically revolve around 90-day cycles, ensuring visibility and control over cash flows.

More than Just Loans : A Full Suite for Every Pursuit!

Looking for flexible financing solutions? Mintifi offers a range of innovative products tailored for small and medium enterprises (SMEs). From inventory financing to seamless payment solutions, Mintifi ensures businesses have what they need to thrive without worrying about cash flow issues.

Inventory Financing

Mintifi specializes in inventory financing that allows businesses to purchase goods without immediate payment. The company offers on-demand Purchase Credit Lines up to ₹2 crore, helping SMEs maintain a steady supply of products without tying up capital. This revolving credit line is perfect for companies looking to increase inventory turnover without depleting cash reserves.

End-to-End Supply Chain Financing

Mintifi’s core product revolves around supply chain financing, covering both Tier 1 and Tier 2 distribution networks. This product ensures businesses get exclusive purchase credit lines that drive higher sales and faster inventory turnover. It allows SMEs to manage cash flow better while covering the last-mile distribution.

End-to-End Invoice Processing (EIPP)

Mintifi’s Electronic Invoice Presentment and Payment (EIPP) platform simplifies the invoicing process. It reduces inefficiencies in invoice reconciliation and helps businesses accelerate their order-to-cash cycle. By automating invoicing and payment reminders, the platform ensures businesses get paid on time.

Short-Term Business Loans

Mintifi offers working capital loans of up to Rs. 50 lakh with repayment terms ranging from 6 to 24 months. These loans come with flexible repayment options (daily or monthly), allowing businesses to manage cash flow effectively. This option is ideal for businesses needing a quick liquidity boost.

WhatsApp Banking

Mintifi is India’s first supply chain financing platform to integrate with WhatsApp, providing a highly user-friendly way to manage invoices, check credit limits, and make repayments directly from the messaging app.

Seamless ERP Integration with APIs

Their API-driven ERP integration ensures that businesses can easily manage their invoices, reconcile accounts, and process payments without friction. This feature allows for seamless management of cash flow, reducing the need for manual oversight.

Global Impact : Funding The Fintech that Beat the Odds

Mintifi’s impact is largely driven by its ability to deliver value through innovative products. It works with over 100 top-tier brands, including Tata Motors, Jockey, and TVS Motorcycles. Their flexible solutions for supply chain financing have filled a major gap in the market. One of Mintifi’s most significant innovations is its co-lending platform, where it partners with financial institutions and banks to scale its credit offerings.

Since its founding in 2017, the company has raised a total of ₹1,200 crore (approximately $150 million) in equity financing. In March 2023, the company raised $110 million in a Series D round led by Premji Invest, with participation from investors like Norwest Venture Partners, Elevation Capital, and the International Finance Corporation (IFC). This latest round brought Mintifi’s total capital base to over $600 million. (Tracxn)

Earlier in February 2022, Mintifi secured $40 million in a Series C round. Norwest Venture Partners and Elevation Capital also participated in this round, boosting Mintifi’s valuation to $122 million. Mintifi’s Series B round in March 2021 brought in $6 million, while its Series A round in May 2019 raised $11.8 million from IFC and Lok Capital

Since its seed round in 2017, where the company raised $2 million, Mintifi has consistently grown its revenue, reporting ₹227 crore in operating revenue for FY23, up from ₹59.4 crore the previous year.

The Final Mint: Why Mintifi’s Success Is Just the Beginning!

Mintifi has emerged as a game-changer in India’s supply chain financing landscape. By addressing the longstanding issue of access to flexible financing for SMEs, it offers innovative solutions that simplify the process. From revolving credit lines to seamless invoicing, Mintifi has empowered businesses to manage cash flow efficiently.

As Mintifi continues to expand its offerings, including B2B payments and dealer management systems, it is well-positioned to dominate the downstream supply chain financing market. If Mintifi can disrupt the financial ecosystem, what’s stopping you from shaking up your industry? Get started on your vision today!

And while you’re here, why not explore more in-depth profiles and success stories on Venture Kites? We’ve got a ton of articles covering the latest in fintech, startup journeys, and more to keep you motivated and informed.

At a Glance with DORK Company

Dive In with Venture Kites

Lessons From Mintifi

Maintain Profitability While Scaling

Why it Matters: Scaling is exciting, but not at the cost of profitability. A profitable growth strategy ensures long-term sustainability.

Implementation: Focus on increasing revenue while keeping operational costs in check. Use technology to maintain efficiency as you scale.

How Mintifi Implements It: Mintifi has maintained profitability while growing its business by using tech to reduce customer acquisition costs.

Innovate to Address Industry-Specific Challenges

Why it Matters: General solutions often don’t cater to industry-specific problems. Addressing niche challenges allows you to stand out and deliver real value.

Implementation: Focus on understanding the specific pain points of your industry. Tailor your solutions to meet the exact needs of your target market.

How Mintifi Implements It: Mintifi specifically addresses the cash flow challenges of small and medium-sized enterprises (SMEs) by offering tailored financing options that suit their supply chain needs, which traditional lenders often overlook.

Make Technology Your Competitive Edge

Why it Matters: Technology drives efficiency and scalability, allowing you to outpace competitors who rely on outdated methods.

Implementation: Invest in innovative technologies that streamline your operations. Automate repetitive tasks and use technology to enhance customer experiences.

How Mintifi Implements It: Mintifi’s API-driven integration with ERPs allows seamless invoice management and payments, reducing manual work and errors.

Adopt a Scalable Business Model

Why it Matters: Scalability ensures that your business can grow without being limited by operational inefficiencies or resource constraints.

Implementation: Design systems and processes that allow your business to grow exponentially while maintaining or improving efficiency.

How Mintifi Implements It: Mintifi’s plug-and-play approach enables them to quickly scale by tapping into a massive receivables pool, helping them meet growing demand while keeping operations smooth.

Align with Market Trends

Why it Matters: Staying in tune with market trends allows businesses to remain relevant and capitalize on emerging opportunities.

Implementation: Keep a pulse on industry trends through continuous market research. Adapt your offerings to meet these changes.

How Mintifi Implements It: Mintifi’s adoption of B2B payment systems and dealer management solutions aligns with the growing demand for digital solutions in supply chain financing.

Youtube Shorts

Author Details

Creative Head – Mrs. Shemi K Kandoth

Content By Dork Company

Art By Dork Company

Instagram Feed

X (Twitter) Feed

🚀 @MintifiPL is transforming financing for India’s SMEs with a tech-driven approach! 💸💼

— Venture Kites (@VentureKites) October 29, 2024

Let’s dive into how they’re reshaping supply chain financing 👇👇#Fintech #SMEFinancing #Mintifi