Rapyd : The Payment Platform Crossing Borders

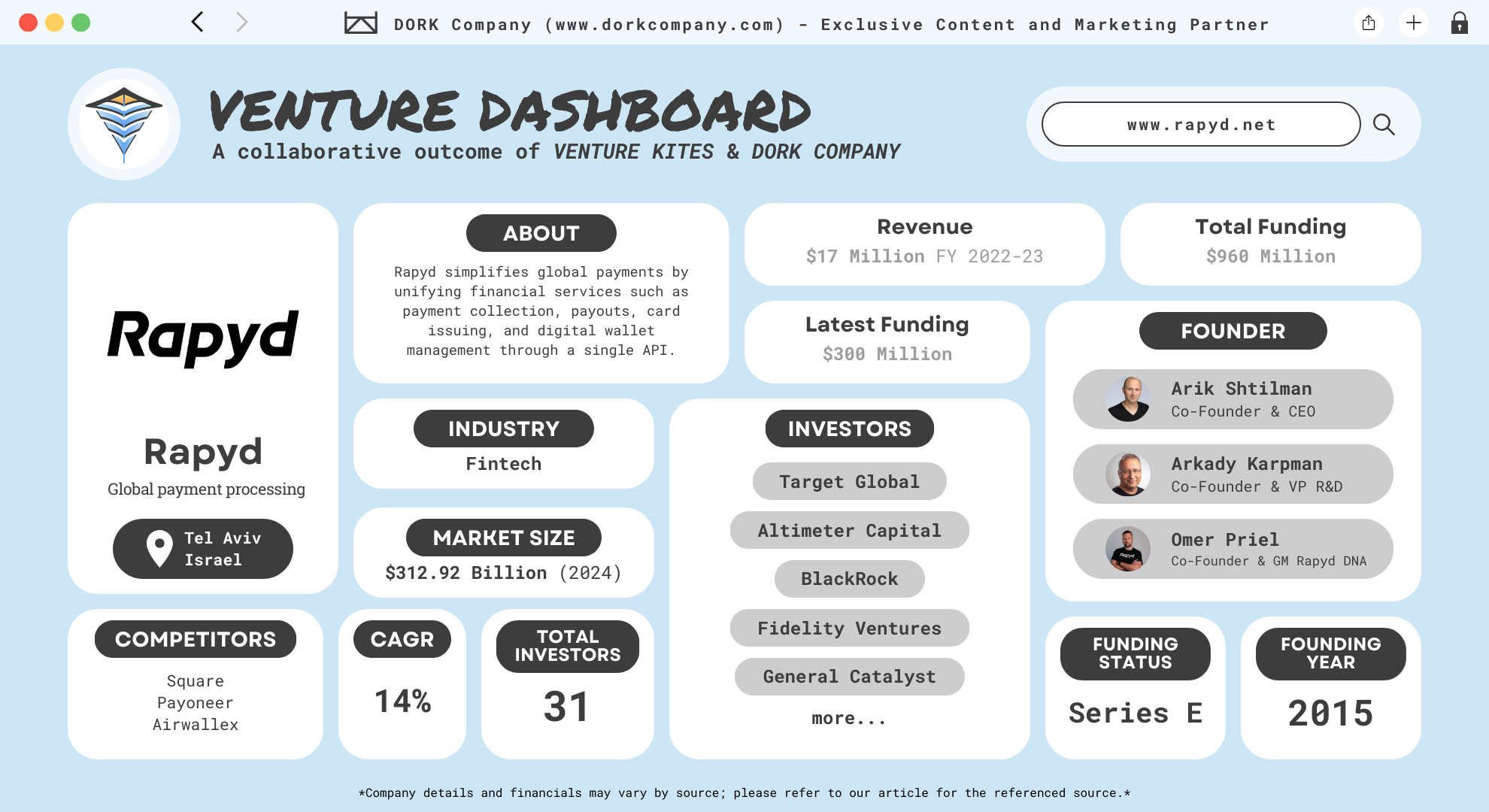

Money moves fast today, and Rapyd is the company racing ahead to make sure global payments keep up, making it easier for businesses to handle transactions across borders. Founded in 2015 by Arik Shtilman, Arkady Karpman, and Omer Priel, the company set out to address the complexity of global commerce. Originally launched in Tel Aviv, Rapyd is now headquartered in London and operates across 100+ countries. (Rapyd)

From its humble beginnings as a mobile payments service, Rapyd has evolved into a fintech powerhouse. Its platform unifies various financial services under one roof, allowing businesses to collect payments, send payouts, issue cards, and manage digital wallets—all through a single API. This comprehensive suite of tools eliminates the headache of dealing with multiple systems, making cross-border transactions faster and smoother.

Rapyd specializes in enabling businesses to accept payments, send payouts, and issue cards globally, no matter the currency or local payment preferences. The company operates in over 170 countries and supports more than 65 currencies, making it a critical player in the growing world of international e-commerce and finance. With a network that spans bank transfers, e-wallets, and cash services, Rapyd makes handling global transactions as easy as local ones.

Rapyd Growth: From Tel Aviv to the World

Arik Shtilman, Arkady Karpman, and Omer Priel launched the company in 2015, originally under the name CashDash, with a goal to solve the complexities of global payments. They realized that handling cross-border transactions required a solution that didn’t exist. So, they built it themselves.

Arik Shtilman – CEO

Arik Shtilman, one of Rapyd’s co-founders and its CEO, has a solid background in the tech and cloud infrastructure space. Before Rapyd, he co-founded ITNAVIGATOR, a cloud computing company that focused on enterprise solutions for communication and data management. This venture was successful, ultimately being acquired by Avaya in 2013. He holds a degree in Computer Science and has extensive experience in building tech infrastructure and enterprise solutions. Arik’s entrepreneurial spirit started early, and his time in the Israeli military instilled in him the perseverance to break into challenging markets. (Arik Shtilman)

Arkady Karpman – VP of R&D

Arkady Karpman, Rapyd’s VP of Research and Development, is the technical mind behind the platform. His previous experiences include extensive work in system architecture and software engineering. Karpman has played a pivotal role in building the technology that powers Rapyd’s global fintech platform. (Arkady Karpman)

Omer Priel – VP of Corporate Development

Omer Priel, who serves as Rapyd’s VP of Corporate Development, has a strong background in corporate finance and strategic business development. Priel has held leadership roles in several financial institutions and startups focusing on mergers, acquisitions, and business expansion. (Omer Priel)

The idea for Rapyd was born when the founders faced excessive foreign exchange fees during a business trip in 2015. They originally aimed to build a digital wallet for consumers but soon realized that businesses faced a much bigger challenge when it came to payments across borders. Seeing a gap in the market for a scalable fintech platform, they pivoted and built Rapyd, which is now one of the world’s leading global payment platforms.

Fintech on Fire: Rapyd’s Playground

The fintech industry is booming, and it’s not slowing down anytime soon. Valued at around $312.92 billion in 2024, it’s expected to soar to $608.35 billion by 2029, growing at a CAGR of 14%. The fintech market is transforming how we handle payments, savings, and investments, making financial services more accessible than ever. (Mordor Intelligence)

One of the biggest trends driving fintech growth is the increasing use of fintech apps. By 2024, the average consumer is expected to use more than three apps to manage their finances, including everything from mobile payments to alternative lending solutions. This rise in fintech usage is fueled by demand for convenience and speed, especially in uncertain economic times when people turn to digital financial tools for stability.

Emerging technologies like artificial intelligence (AI) and blockchain are reshaping how companies handle fraud detection, credit scoring, and compliance. AI is particularly revolutionizing money management by automating tasks like budgeting and investing, while blockchain is making transactions faster and more secure.

Regulatory technology (RegTech) is also gaining traction, particularly in regions like Europe where financial regulations are complex. This helps fintech companies ensure compliance without sacrificing innovation. Furthermore, as instant payment rails like FedNow gain momentum, real-time payments are set to become a key component of the financial landscape. (Fortune Business Insights)

Crossing Borders, Not Boundaries : A Unified Mission to Simplify Fintech

Rapyd’s mission to simplify global financial transactions. The company aims to empower businesses by providing a single platform that integrates payments, card issuing, and digital wallet services, all through one API. This helps companies avoid the complexity of navigating multiple financial systems across different regions. (About Rapyd)

Vision for an Inclusive Financial World

Rapyd envisions a future where financial services are accessible to everyone, regardless of location or economic status. Their goal is to break down traditional banking barriers, allowing businesses and individuals to participate in the global economy seamlessly.

Problems Rapyd Solves

At its core, Rapyd solves three main problems:

- Cross-border Payment Complexity: Managing payments across countries with different currencies and regulations can be a logistical nightmare. Rapyd simplifies this with its global payment network, which supports over 170 countries.

. - Fragmented Financial Systems: Instead of dealing with numerous payment gateways, companies can use Rapyd’s single platform to manage multiple payment methods, currencies, and regions.

- Compliance and Security: Rapyd ensures businesses stay compliant with local financial regulations, reducing the complexity of handling international legal requirements. This also includes advanced fraud detection and security features.

Business Model: Global Fintech as a Service

Rapyd’s business model revolves around its comprehensive financial services platform, generating revenue from transaction fees, foreign exchange fees, API access, and subscription services. It offers a single integration point for businesses to access a global network of payment systems, digital wallets, and card issuance. This scalable solution allows companies to grow without the need to develop their own financial infrastructure.

Pay Like Lightning : All-in-One Financial Toolbox for Global Payments

Rapyd has built an extensive suite of financial solutions designed to simplify how businesses handle payments globally. Its platform integrates various payment methods, currency exchanges, and other financial services, all through a single API. Whether you’re a small business or a multinational company, Rapyd offers everything you need to process transactions across borders with ease. (Solutions)

Payments Everywhere

Rapyd’s payment solutions allow businesses to accept payments through hundreds of local and international methods. This includes credit and debit cards, bank transfers, e-wallets, and even cash. For e-commerce companies, Rapyd Hosted Checkout simplifies online transactions by integrating multiple local and alternative payment methods into a seamless process. Rapyd’s multi-currency capabilities ensure seamless transactions across regions, allowing businesses to accept payments in more than 100 currencies. (Payments)

Global Payouts

Rapyd’s Disburse platform offers cross-border payouts, making sending funds worldwide faster and cheaper. Businesses can disburse payments in local currencies across 190+ countries, from bank transfers to mobile wallets. This tool ensures businesses can pay employees, vendors, or partners with minimal hassle. (Payouts)

Issuing

Rapyd’s issuing services let businesses create both virtual and physical cards. Companies can use these cards to manage employee expenses, build branded card programs, or issue customer loyalty cards. With real-time authorization options and fraud filters, businesses can easily control and monitor card transactions. (Issuing)

Wallets

Rapyd also provides a digital wallet solution, allowing businesses to create custom wallets for storing and transferring funds. This feature is particularly useful for applications like loyalty programs, e-commerce, or remittances. Rapyd’s wallet can be integrated with other solutions like its payment and card services.

API and Integrations

Rapyd’s API-first approach ensures that developers can easily integrate its services into existing platforms. It offers plugins for popular e-commerce systems like Shopify, WooCommerce, and Wix, making it simple to manage international payments.

Rapyd Results : Bridging Borders With a Global Impact

Rapyd is redefining the global payments space, and the impact is clear. With a recent valuation of $15 billion, Rapyd is Israel’s highest-valued fintech unicorn and has also become a key player on the global stage. Its rapid growth, fueled by strategic acquisitions such as the $610 million purchase of PayU, has expanded its reach to over 100 countries and strengthened its position in the cross-border payments market. (Techcrunch)

Rapyd has been consistently recognized as one of the top cross-border payment providers. For five consecutive years, FXC Intelligence has ranked Rapyd among the top 100 companies in cross-border payments. In 2024, Rapyd also won the MPE Award for “Best Cross-Border Merchant Solution,” further solidifying its place as a leading solution for global businesses. (MPE Award) (FXC Intelligence)

Strategic Collaborations with Fintechs

One of Rapyd’s most impactful initiatives is its Payment Partner Programme, which empowers Independent Sales Organizations (ISOs), Payment Facilitators (PayFacs), and other businesses by providing them with tools to streamline payment processes and expand globally. Rapyd partners with innovative fintech companies to expand its services. For instance, it collaborates with Banked to enhance pay-by-bank solutions, offering businesses more cost-effective and secure account-to-account payments. Similarly, the partnership with Nexio focuses on providing risk-free embedded payments, targeting the rapidly growing market in Latin America. (Payment Partner Programme)

Money Talks: Rapyd’s Financial Success Story

Rapyd’s journey in the fintech world has been backed by massive financial support from some of the biggest names in venture capital. In 2022, Rapyd reached a $15 billion valuation, making it Israel’s highest-valued fintech unicorn. In total, Rapyd has raised over $960 million from several rounds, with significant contributions from investors like SoftBank Vision Fund, General Catalyst, and Fidelity. (Tracxn)

Series E – August 3, 2021

Rapyd raised $300 million in its Series E round, which valued the company at a staggering $8.8 billion. This funding round was led by institutional investors such as Target Global, Fidelity Ventures, and General Catalyst, along with corporate investors like BlackRock and Stripe. At this stage, Rapyd’s revenue reached $12.7 million, with a 691.1x multiple, solidifying its position as a major player in the fintech world.

Series D – January 13, 2021

In Series D, Rapyd raised another $300 million, further boosting its growth trajectory. This round saw participation from top-tier investors like Coatue, General Catalyst, and Tiger Global Management. Rapyd’s revenue during this period was $11.6 million.

Series C – October 1, 2019

During its Series C, Rapyd raised $100 million, backed by Oak HC/FT, Tiger Global Management, and Stripe. This round focused on expanding its payment platform’s global reach. A smaller portion, $20 million, was raised in December 2019 from Durable Capital Partners.

Series B – February 13, 2019

Rapyd raised $40 million in its Series B from General Catalyst, Target Global, and Stripe, helping the company strengthen its infrastructure for cross-border payments.

Earlier Rounds

Rapyd’s journey began with undisclosed amounts in its Seed and Series A funding rounds. Early supporters included Tal Capital and Entree Capital, which helped lay the groundwork for its fintech as a service platform. Rapyd’s revenue has experienced steady growth over the years, reflecting its expanding global presence and increasing demand for its fintech solutions. In 2023, Rapyd generated $17.4 million in revenue, up from $16 million in 2022 and $12.1 million in 2021.

Rapyd Rise: This Unicorn is Far from Finished

Rapyd is proof that fintech is reshaping the future of global commerce, breaking barriers and simplifying cross-border payments. Its rapid rise, fueled by strategic funding and acquisitions, has made it a key player in the world of payments. With a valuation of over $15 billion and a constantly growing global footprint, Rapyd is on a mission to transform the way businesses and individuals handle financial transactions.

Rapyd’s journey is far from over. As it continues to expand and innovate, the company is set to revolutionize the fintech space further, offering businesses new ways to navigate the complex world of international finance.

So, what are you waiting for? Whether you have a small startup idea or are dreaming of disrupting an industry, now is the time to take action. The fintech world is booming, and the opportunities are endless.

Curious about more game-changing companies? Check out other articles on Venture Kites to get inspired, learn, and maybe even find your next big idea.

At a Glance with DORK Company

Dive In with Venture Kites

Lessons From Rapyd

Spot and Address Gaps in the Market

The Lesson & Why it matters: Identify unmet needs in the market and develop a solution that adds value. This drives long-term success.

Implementation: Conduct market research to find pain points. Build a product that solves these issues effectively.

How Rapyd Implements It: Rapyd found a gap in cross-border payments. It created an all-in-one platform that simplifies global payments, providing much-needed solutions for businesses.

Pivot When Necessary

The Lesson & Why it matters: Be flexible and ready to pivot when your original idea isn’t the best solution. This can lead to growth.

Implementation: Evaluate feedback and market conditions regularly. Don’t be afraid to change course if needed.

How Rapyd Implements It: Rapyd initially started as a digital wallet but pivoted to provide a broader payment infrastructure, which led to its massive growth.

Embrace Globalization

The Lesson & Why it matters: Expand beyond your local market. Global reach brings more opportunities for growth and stability.

Implementation: Localize your product to fit different markets. Be mindful of regional regulations and preferences.

How Rapyd Implements It: Rapyd operates in over 100 countries and supports hundreds of local payment methods. This helps it capture diverse global markets.

Build a Scalable Infrastructure

The Lesson & Why it matters: Scalability is key to growth. A strong, adaptable infrastructure allows your business to expand smoothly.

Implementation: Invest in technology that can scale with your business. Use cloud-based solutions to ensure flexibility.

How Rapyd Implements It: Rapyd built its platform using scalable APIs, enabling companies of all sizes to integrate its payment solutions as they grow.

Use Strategic Acquisitions for Growth

The Lesson & Why it matters: Acquisitions can help expand your capabilities and reach new markets quickly.

Implementation: Identify companies that complement your product offering. Make strategic acquisitions to accelerate growth.

How Rapyd Implements It: Rapyd acquired companies like Valitor and Neat, expanding its presence in Europe and Asia.

Youtube Shorts

Author Details

Creative Head – Mrs. Shemi K Kandoth

Content By Dork Company

Art By Dork Company

Instagram Feed

X (Twitter) Feed

🚀 @rapyd is simplifying global commerce with its all-in-one payment platform! 🌐

— Venture Kites (@VentureKites) October 27, 2024

💸 Let’s explore how they’re transforming cross-border payments and empowering businesses worldwide 👇👇#Fintech #GlobalPayments #Rapyd